The institutional floodgates for Solana are officially open. In a massive show of conviction, Mike Novogratz’s Galaxy Digital purchased a staggering 2.2 million SOL (worth approximately $486 million) on September 12. This isn’t an isolated trade; it’s part of a coordinated strategy to fund a newly-debuted Solana treasury vehicle, highlighting a seismic shift toward institutional accumulation of the high-speed blockchain’s native token.

The Details of Galaxy’s Massive Purchase

On-chain data tells the story. Trackers from Lookonchain and Arkham Intelligence show that Galaxy Digital sourced its SOL from major exchanges like Binance and Coinbase, moving enormous tranches from exchange hot wallets into its own secure

custody.

This purchase is a key part of a broader, billion-dollar plan. Galaxy is a lead investor and strategic partner in Forward Industries, which recently closed a $1.65 billion private placement. The proceeds from this raise are dedicated to long-term SOL accumulation, funding a dedicated cryptocurrency treasury operation.

The Big Picture: $2.44B in Institutional Holdings

Galaxy Digital is not alone. They are part of a growing cohort of major firms building substantial Solana treasuries.

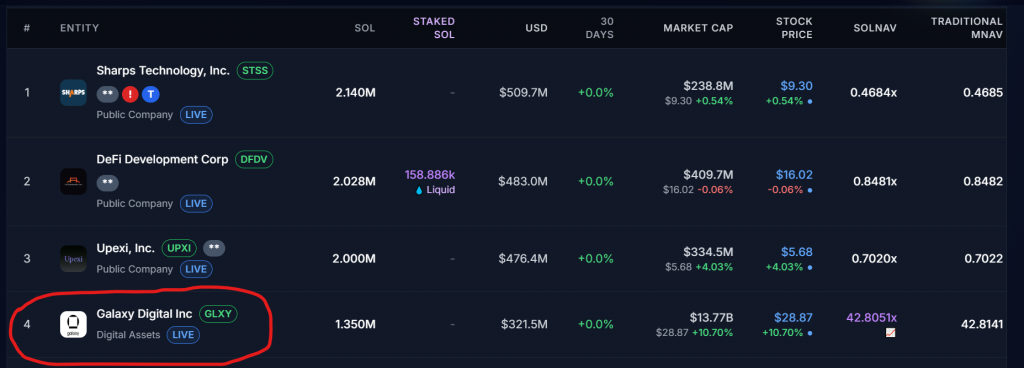

- Total Institutional SOL: 10.27 million (worth $2.44 billion)

- Percentage of Supply: ~1.79% of Solana’s total supply

- Number of Entities: 14 verified public companies and digital-asset specialists

This represents a sharp climb from just earlier in September, proving that large-scale, methodical accumulation is only accelerating.

Who Are the Biggest SOL Whales?

The list of top holders is a mix of public companies and crypto-native specialists:

- Sharps Technology: The largest holder, with 2.14 million SOL (~$508M).

- DeFi Development Corp: Recently made a $40M purchase to push its holdings over 2 million SOL.

- Galaxy Digital: Now ranks among the top holders after its latest half-billion dollar purchase.

Price Impact and Future Outlook

This institutional bid is providing powerful support for SOL’s price. At the time of writing, SOL is trading around $237, up 6.27% in 24 hours and an impressive 16.13% over the past week.

As these major firms continue to execute their treasury strategies, they create a solid foundation of demand that could propel SOL toward key resistance levels near $265 and beyond.

The Bottom Line

Galaxy Digital’s nearly $500 million purchase is a definitive statement. Institutions are no longer just experimenting with Solana; they are making massive, strategic bets on its long-term future. The $2.44 billion now held in corporate treasuries is a testament to Solana’s maturation from a retail-friendly blockchain to an institutional-grade asset. For investors, this provides a strong fundamental backdrop that suggests the current rally may have much further to go.