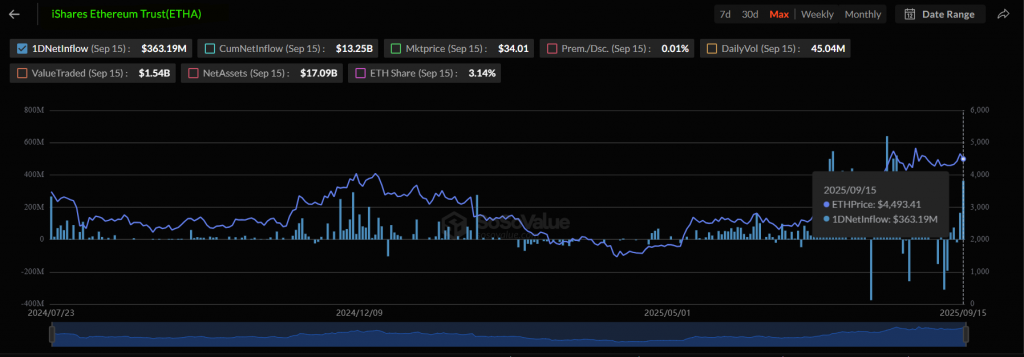

BlackRock’s spot Ethereum ETF (ETHA) is making a powerful comeback. The fund has just recorded its largest single-day inflow in 30 days, signaling a dramatic rebound after a period of heavy sell-offs.

A Record-Breaking Day for Inflows

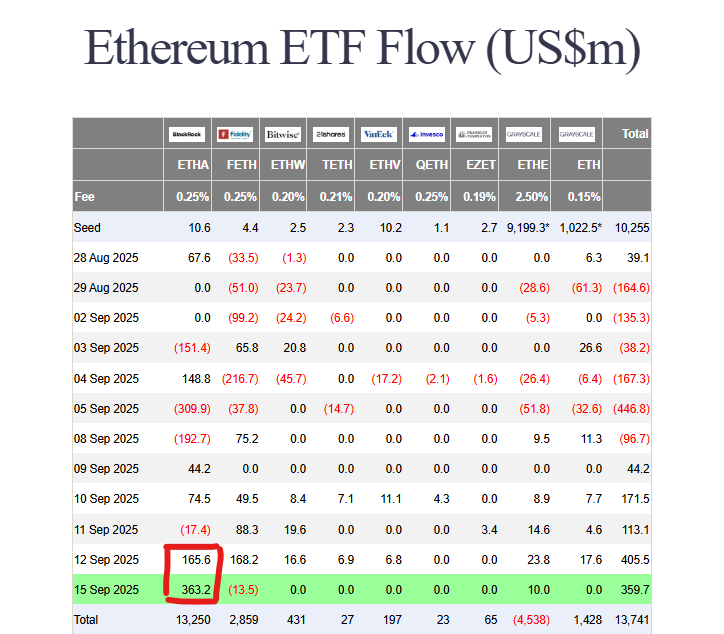

According to data from SoSoValue, the ETHA fund attracted a massive 80,768 ETH on September 15. This inflow is worth approximately $363 million and pushed the fund’s daily trading volume to an impressive $1.5 billion.

This surge represents a stunning reversal of fortune. Just days before, between September 5 and 12, the ETF had suffered net outflows totaling $787 million. This new wave of capital suggests that institutional appetite for Ethereum is strongly returning.

Leading a Broader ETF Recovery

BlackRock’s fund isn’t alone in this recovery. Last week, the entire spot Ethereum ETF market saw $638 million in net inflows.

Fidelity’s FETH led the charge with $381 million in fresh capital. Meanwhile, Grayscale’s ETHE and Bitwise’s ETHW also posted steady, positive inflows. Notably, not a single major fund reported outflows during this period, indicating widespread and stable institutional demand.

As of September 12, these ETFs collectively manage a staggering $30.35 billion in assets. BlackRock holds the lion’s share with $17.25 billion under management.

Ethereum’s Price and Ecosystem Strength

Despite the huge inflow, Ethereum’s price has shown short-term weakness, underperforming the broader crypto market. Key indicators suggest the asset is in a consolidation phase.

However, the fundamental health of the Ethereum ecosystem remains robust. The network’s total stablecoin supply recently hit a record high of $166 billion. This growth underscores Ethereum’s critical role as the backbone of DeFi, even during price volatility.

BlackRock’s Broader Blockchain Ambitions

This momentum isn’t stopping at ETFs. Reports indicate BlackRock is also exploring ways to tokenize its exchange-traded products, including those tied to real-world assets (RWAs), directly on blockchain infrastructure.

This record inflow provides a strong counterweight to recent losses and could be the catalyst for a price recovery, proving that institutional confidence in Ethereum is far from diminished.