Ethereum is facing a sharp sell-off, with its price retracing significantly due to a powerful combination of whale selling, massive liquidations, and a notable shift in overall market sentiment.

As of this writing, Ethereum is down 6.8% over the past 24 hours, trading at $4,173. The asset has now lost 10% over the last week and 12% over the past month, signaling a clear cooling-off period after its recent rally.

Liquidations and Whale Activity Drive the Sell-Off

The drop was accompanied by a dramatic surge in trading activity. Spot volume jumped 124% to $32.5 billion, while derivatives volume skyrocketed 183% to $93.8 billion.

However, open interest fell by 5.2%, indicating that traders were rapidly closing their positions rather than opening new ones. This imbalance led to a bloodbath in the futures market.

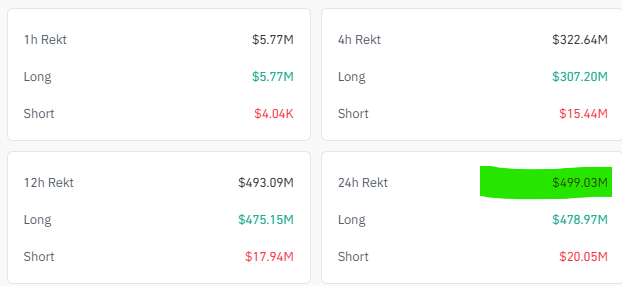

A staggering $495 million in ETH positions were liquidated in the past day. Long traders bore the brunt of the pain, absorbing $478 million of those losses as the price moved sharply against them.

Market Sentiment Shifts to “Fear”

For the first time this month, the overall crypto market sentiment has tipped into “fear” territory. The Crypto Fear & Greed Index fell four points to a reading of 46.

On-chain data reveals that some large holders, or “whales,” began moving their coins to exchanges. This activity is a classic indicator of increasing sell-side pressure, suggesting that risk-aversion and profit-taking are driving the current short-term price action.

This pullback aligns with a historical trend; September has notoriously been one of the worst months for cryptocurrency returns.

Ethereum Price Technical Analysis: Key Levels

The technical picture has turned bearish in the short term. ETH has broken below its key 20-day moving average, and both the Momentum and MACD indicators are flashing sell signals.

The Relative Strength Index (RSI) is near 40, approaching oversold conditions but not quite there yet.

- Key Support: Immediate support sits at $4,150. A break below this level could expose a deeper retracement toward $3,800.

- Key Resistance: To revive bullish momentum, ETH must reclaim the $4,400 level. A decisive move above $4,500 would be needed to open a path back toward the recent highs near $4,700.

Despite the immediate pressure, the long-term outlook remains hopeful. Major catalysts like the upcoming Fusaka upgrade and growing institutional access through ETFs could provide a strong foundation for a Q4 rebound. Many analysts still forecast a run above $5,000 by year-end if macroeconomic conditions stabilize.