The crypto market is having a rough start to the week, with major tokens sliding significantly from their recent highs. This has cast a cautious shadow over “Uptober”—a month historically known for strong crypto gains—which is now just eight days away.

The global cryptocurrency market cap has fallen nearly 4% in the past 24 hours, shedding approximately $158 billion in value. Let’s break down the slump and explore why it’s happening.

Major Cryptos Follow Bitcoin’s Retreat

The sell-off is broad-based, impacting nearly all top cryptocurrencies.

- Bitcoin (BTC): After starting the day above $115,000, BTC slid as low as $112,000. It is currently down 2.31% on the day.

- Ethereum (ETH): ETH has dropped roughly 6% in 24 hours and about 10% over the past week, falling to around $4,200.

- Solana (SOL): SOL is down more than 7%, erasing its recent gains and trading near $222.

- XRP: Other major altcoins like XRP have also slipped, falling about 5-6%.

4 Key Reasons Behind the Price Drop

So, why are crypto prices falling right now? Several factors are converging to drive the pullback.

1. Profit-Taking After Recent Highs

Investors appear to be locking in gains after a strong recovery. Bitcoin recently touched $118,000, Ethereum climbed to $4,600, and BNB broke above $1,000 for the first time. This wave of selling into strength has naturally added downward pressure.

2. A “Hawkish” Fed Rate Cut

Last week’s widely anticipated Fed rate cut ultimately disappointed markets. While the 0.25% reduction was positive, Chairman Jerome Powell stressed that future cuts are not guaranteed. This cautious tone cooled investor sentiment and turned a potential rally into a sell-off.

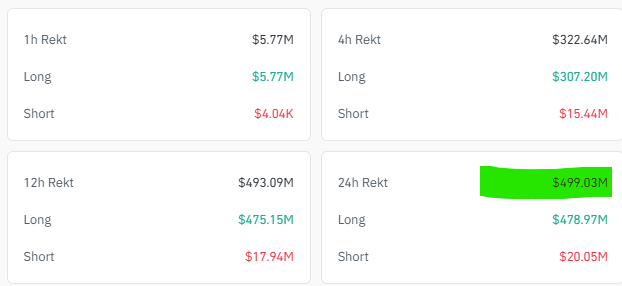

3. Massive Leveraged Liquidations

The volatility has been brutal for leveraged traders. In the past 24 hours, more than $1.7 billion in positions were liquidated. Long trades on Bitcoin and Ethereum made up the majority of these losses, exacerbating the price decline.

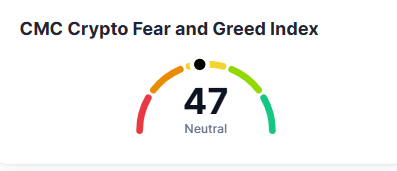

4. Shifting Market Sentiment

The data reflects the new mood. The Crypto Fear & Greed Index has dropped from 49 to 45, signaling a swift move toward fear and caution among traders.

Is a Uptober Comeback Still Possible?

Despite the current pessimism, history offers a glimmer of hope. October has earned the nickname “Uptober” for a reason. Over the past five years, the month has consistently delivered double-digit percentage gains on average.

Furthermore, on-chain data shows continued exchange outflows, meaning long-term holders are moving their coins to cold storage. This suggests that underlying conviction in the market remains strong.

If macroeconomic conditions stabilize and buying pressure returns, the seasonal Uptober trend could still help crypto prices regain their momentum.