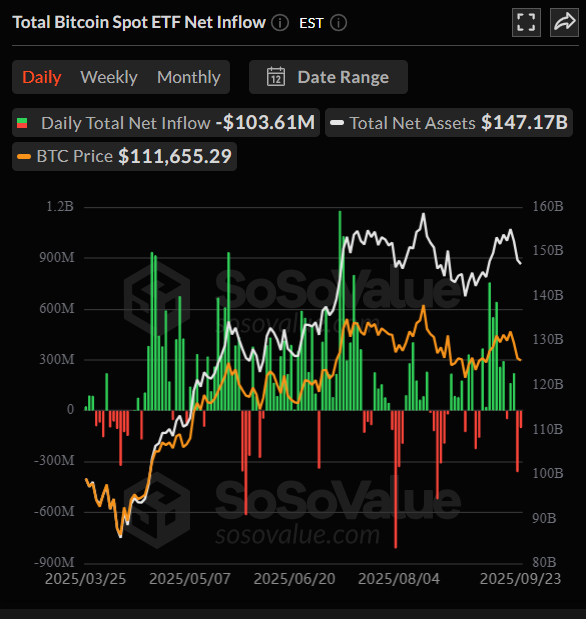

US spot Bitcoin ETF have faced a wave of selling pressure. Data indicate a second consecutive day of large Bitcoin ETF outflows, valued at nearly $467 million in the span of two days. This action occurs at the same time as a broader bearish trend in the crypto market.

Breaking Down the Bitcoin ETF Outflows

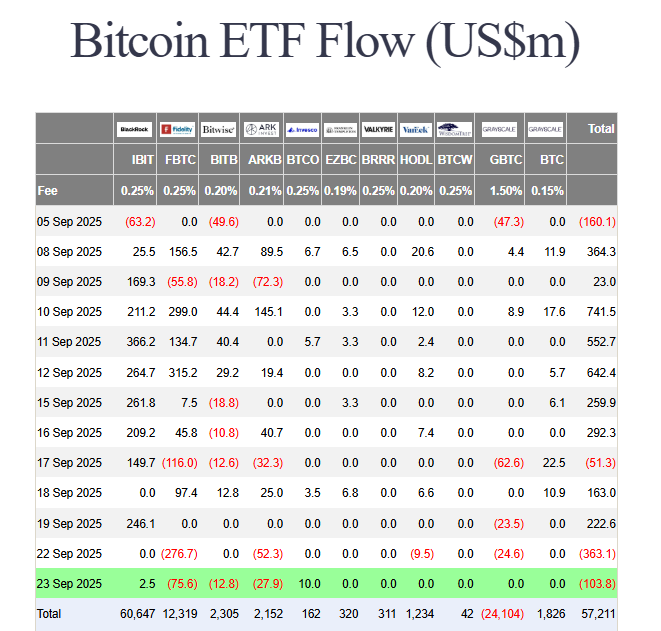

On Tuesday, Sept. 23rd, the ETFs experienced net redemptions of $103.61 million. Fidelity’s FBTC initiated the selling with $75.56 million in redemptions. ARK 21Shares (ARKB) and Bitwise (BITB) funds also witnessed outflows.

But it wasn’t all ugly. Invesco’s BTCO saw $10.02 million in inflows, and BlackRock’s IBIT saw a modest $2.5 million inflow. As bad as last week’s Bitcoin ETF outflows were, please remember that September remains a net positive month with over $3 billion pouring in, a significant rebound from August’s performance.

What’s Behind the Market Reversal?

The key driver of this change is a sentiment shift toward the Federal Reserve. Initially, markets had been eager for a rate cut earlier last week. But hope quickly was quashed after Fed policymakers signaled fewer 2025 cuts than had been previously forecast.

This “hawkish” tone, repeating that subsequent actions are “data dependent,” left people confused. It therefore pulled risk appetite out of the market, releasing a cascade of liquidations. On Monday alone, over $1.7 billion worth of crypto positions were liquidated, taking Bitcoin from $115,000 to a low of $111,369.

The exits are probably “profit-taking and not a fundamental issue,” says Komodo’s CTO, Kadan Stadelmann, which is to say long-term conviction remains.

Bitcoin Price Forecast: Levels to Watch

So where next for Bitcoin? The analysts are watching key levels.

- Support: Remaining above the $110,000 level is crucial to avoid another correction.

- Resistance: A grind higher back towards $118,000 slowly could suggest a continuation of the bigger uptrend.

Currently, social opinion on social media is heavily bearish, with the majority predicting a drop to the $70,000-$100,000 range. As of writing, Bitcoin trades at $112,639, having fallen modestly in the last 24 hours while waiting for direction.