The stunning rally for Binance chain Coin BNB price has hit a dramatic wall. In a sharp reversal, the price has crashed through the critical $1,000 support level, leaving investors scrambling. The crucial question now is whether this is a simple pause or the terrifying start of a major collapse.

Current Market Snapshot

At the time of writing, BNB is trading around $991, marking a 2.6% decline over the last 24 hours. More significantly, it has retraced about 7.8% from its all-time high of $1,083, set on September 3rd.

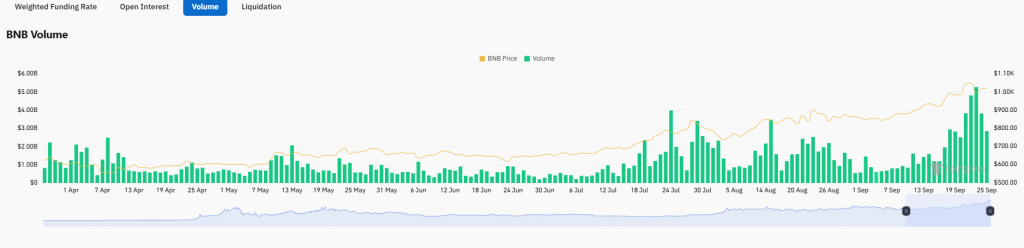

This pullback is accompanied by a clear drop in market activity. Spot trading volume has decreased by 17% to $2.40 billion. Similarly, derivatives data shows open interest and futures volume are also down, suggesting a reduction in speculative leverage and short-term momentum.

What’s Driving the Pullback?

BNB has been a top performer this cycle, breaking decisively above its previous peak of $793 in August. This breakout propelled it into “price discovery” mode, eventually leading to its new record high.

Analysts point to the growing synergy between Binance and the Aster perpetual DEX as a key source of demand and confidence. However, they also caution that the rally showed signs of being overheated. The recent buying wave was likely influenced by FOMO (Fear Of Missing Out), which often leaves a market vulnerable to a sharp BNB price correction when liquidity slows.

BNB Price Prediction: Key Levels to Watch

From a technical perspective, BNB is at a critical juncture.

- Support: The immediate support level to watch is $980. A break below this could see the

BNB pricecorrection deepen toward the $950 – $935 range. - Resistance: On the upside, the token needs to reclaim $1,010 to signal a recovery of bullish momentum, with a next target of $1,050.

The Relative Strength Index (RSI) is at 38, indicating increasing bearish pressure but not yet oversold conditions. While short-term moving averages are flashing sell signals, the medium- and long-term trends remain bullish, suggesting this could be a cooling period within a larger uptrend.