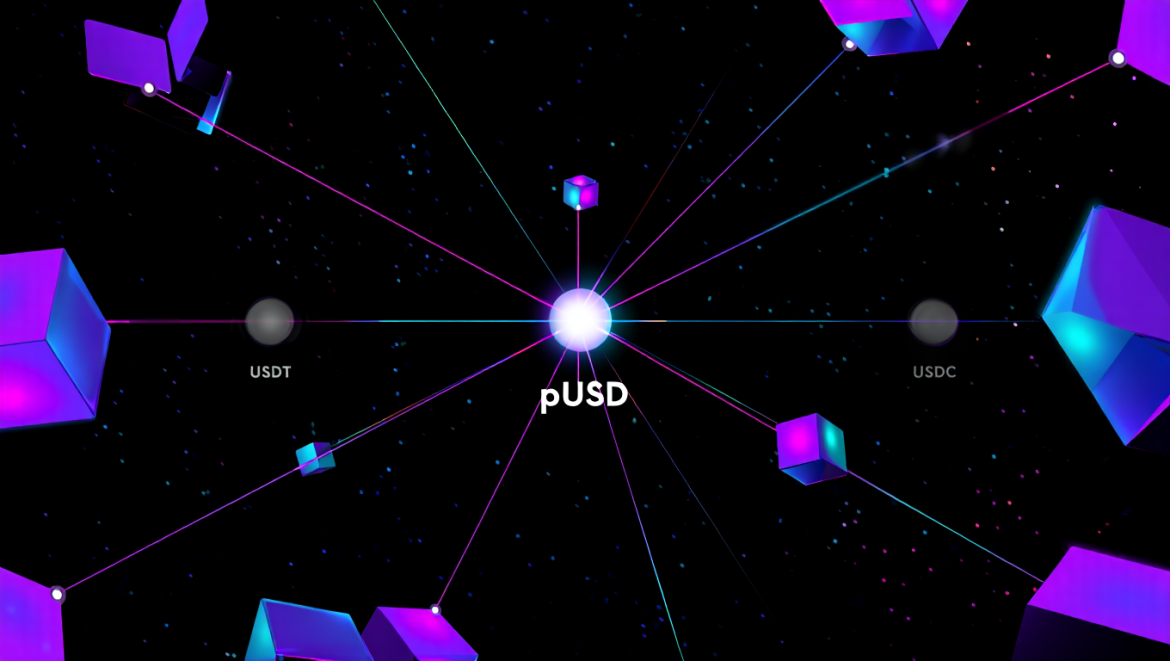

The Polkadot ecosystem is on the verge of a monumental leap. In a decisive move to claim its financial independence, the community is overwhelmingly backing a proposal to create the Polkadot pUSD stablecoin. This new asset is designed to be a decentralized, DOT-backed powerhouse that directly challenges the dominance of USDT and USDC.

What is Polkadot pUSD and Why Does It Matter?

The Polkadot network stands at a turning point. A governance vote now under way asks whether the chain should launch its own stablecoin, pUSD. At the time of writing, 75.4 % of votes back the plan – the measure passes at 85.6 %. The token would be minted only when users lock DOT in a vault – every unit of pUSD is over collateralised by the native asset. Holders keep exposure to DOT price moves and gain spendable dollars at the same time.

Overwhelming Community Support

The design cuts Polkadot’s dependence on USDT besides USDC. Treasury spends, payroll staking payouts and routine DeFi trades could all settle in pUSD – value stays inside the relay chain economy instead of leaking to outside issuers. Gavin Wood, co founder of the network, labels a native stablecoin “strategically essential” and warns that continued reliance on external coins could drain liquidity and security.

A Critical Move to Unlock Polkadot’s DeFi Potential

Polkadot currently hosts less than $100 million in stable value tokens. Ethereum or Solana each measure the same figure in the tens of billions. The gap chokes lending markets, derivatives and payment apps. A DOT-backed dollar would give builders a local unit of account and, if the proposal passes, place the ecosystem inside the projected $4 trillion global stablecoin market.