The Bitcoin price rally has reached a historic milestone, catapulting BTC to a new all-time high above $125,000. This powerful surge is fueled by a perfect storm of institutional demand and bullish macroeconomic expectations.

Key Drivers of the Bitcoin Price Rally

The current Bitcoin price rally is supported by two major factors. Firstly, spot Bitcoin ETFs recorded their largest weekly inflows of the year at $3.24 billion, demonstrating massive institutional conviction.

Secondly, markets are pricing in a 97% chance of a Federal Reserve rate cut this month. Consequently, this expectation is creating a favorable environment for risk assets like Bitcoin.

Market Impact and Liquidations

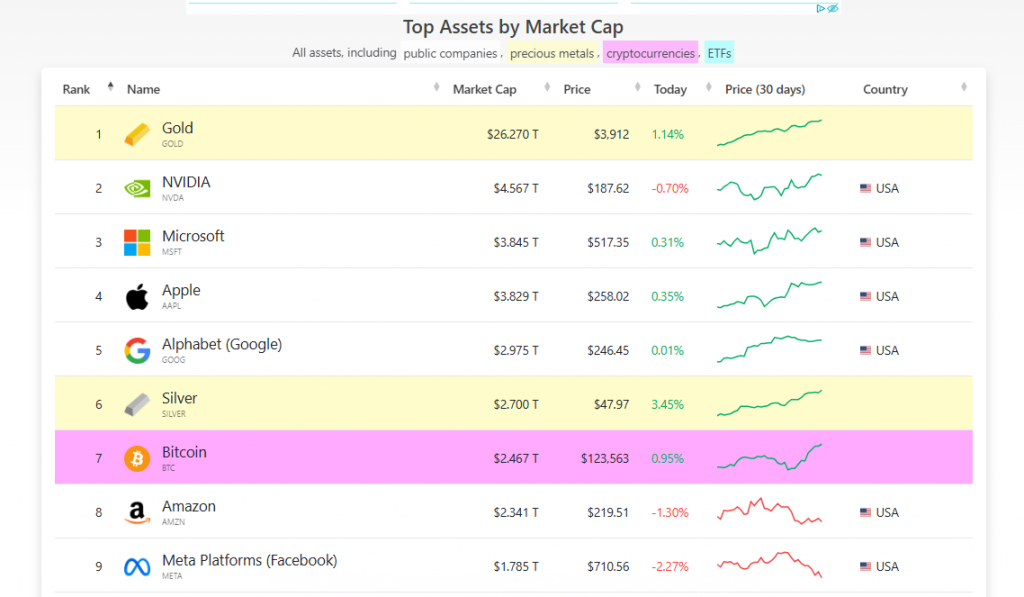

The relentless Bitcoin price rally has solidified Bitcoin’s position as a top global asset. Its market cap now stands at $2.5 trillion, making it the seventh-largest asset worldwide, surpassing giants like Meta.

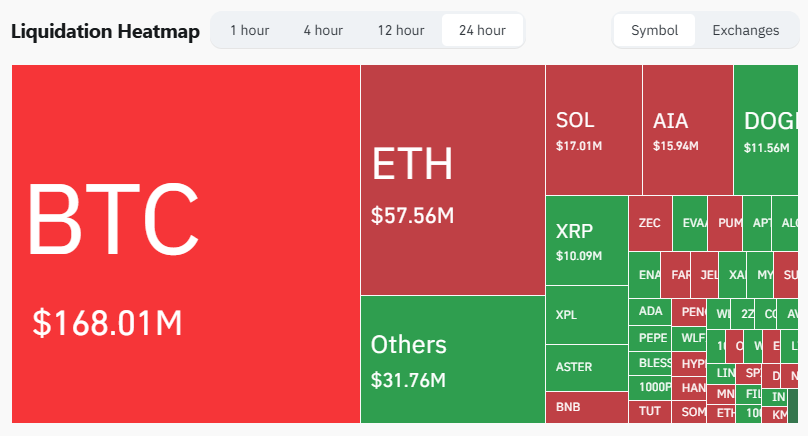

However, the rapid ascent has triggered significant liquidations. According to CoinGlass, $168 million in positions were liquidated in 24 hours, with $132 million being short bets caught off guard.

The “Uptober” Momentum

The Bitcoin price rally is amplified by strong seasonal trends. Historically, October is a bullish month for Bitcoin, and this year is no exception. BTC is already up over 6% this month, setting the stage for a potentially explosive fourth quarter.