A powerful Ethereum price rally has pushed ETH above $4,600, defying a significant sell-off from the Ethereum Foundation. This surge demonstrates strong underlying demand, as institutional inflows and bullish derivatives activity overwhelm typical negative sentiment.

Bullish Momentum Ethereum Price Rally

The Ethereum price rally occurred despite the Ethereum Foundation selling 1,000 ETH (worth ~$4.6 million) to fund operations. Historically, such sales have caused price dips.

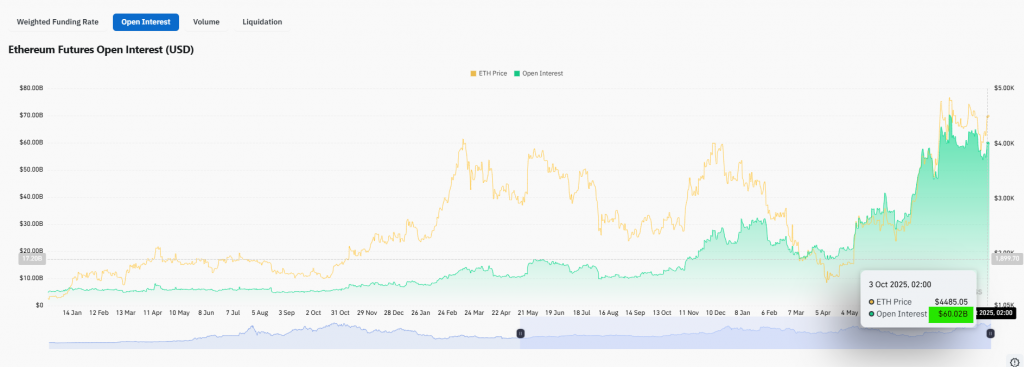

However, this time, the market reaction was different. Instead of falling, ETH attracted $700 million in new long positions over the weekend. Consequently, open interest rose to $41.3 billion, signaling strong trader conviction.

ETF Inflows Provide a Solid Foundation

The sustained Ether price rally is backed by massive institutional demand. Spot Ethereum ETFs recorded a massive $1.3 billion in net inflows last week over five consecutive days.

Additionally, corporate treasuries like Bitmine continue to accumulate, now holding 2.6 million ETH. Therefore, this institutional support is providing a solid foundation that counteracts selling pressure.

Price Outlook: A Test of $4,750?

The current Ethereum price rally has successfully defended the $4,600 level. If open interest continues to climb alongside steady ETF inflows, the next logical target is a test of $4,750 in the coming week.