Bitcoin has achieved a monumental milestone, surging to a new Bitcoin all-time high above $126,000. This record-breaking rally is largely driven by the ongoing U.S. government shutdown, which is fueling a “debasement trade” as investors seek a safe-haven asset.

Shutdown Fuels Rally to New Bitcoin All-Time High

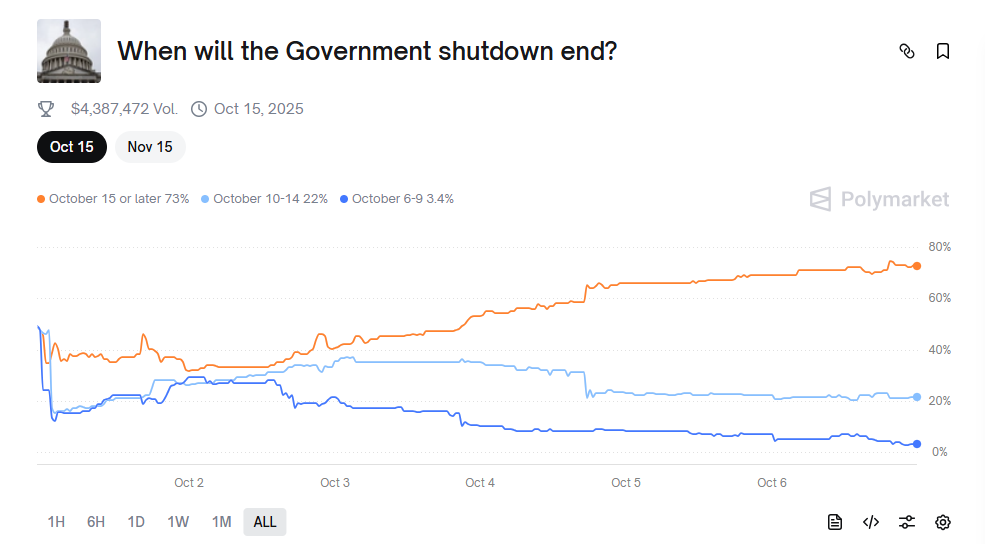

The new Bitcoin all-time high coincides with significant political uncertainty. Data from Polymarket indicates a 72% chance the government shutdown will persist until at least October 15.

Consequently, investors are flocking to Bitcoin as a hedge against economic instability. Since the shutdown began on October 1, BTC has rallied nearly 10%, with spot ETFs recording a massive $3.24 billion in net inflows last week alone.

Analysts Predict Further Gains

Following the new Bitcoin all-time high, analysts are forecasting even more upside. Banking giant Standard Chartered predicts a surge to $135,000 in the near term and $200,000 by year-end.

Prediction markets reflect this optimism, showing a 68% chance Bitcoin hits $130,000 this month. The combination of institutional ETF demand and macroeconomic uncertainty creates a powerful bullish narrative.

The Technical Outlook

The path to this Bitcoin all-time high has been characterized by a steady grind within a bullish channel. Analysts suggest that if this momentum holds, a test of the $135,000 level is highly probable before October concludes.