Coinbase has officially added DoubleZero (2Z) to its listing roadmap, marking a significant regulatory milestone for the Solana-based DePIN project. This DoubleZero listing follows a pivotal decision by the U.S. Securities and Exchange Commission (SEC), which issued a no-action letter confirming the 2Z token is not a security.

SEC Green Light Precedes DoubleZero Listing

The DoubleZero listing on Coinbase comes directly after a major regulatory victory. The SEC’s Division of Corporation Finance issued a formal no-action letter, stating it would not recommend enforcement action against DoubleZero.

Consequently, the regulator confirmed that the 2Z token is a functional incentive, not an investment contract. This clarification provides crucial regulatory certainty, not just for DoubleZero but for the entire decentralized physical infrastructure (DePIN) sector.

What is DoubleZero?

DoubleZero is a DePIN protocol designed to enhance blockchain scalability through real-world data infrastructure. Essentially, it uses a decentralized network to provide physical services like data storage and computing power.

The DoubleZero listing on a major regulated exchange like Coinbase validates its model and introduces it to a vast new audience. The token had already been listed on other major exchanges like Binance and Kraken.

Market Reaction and Price Action

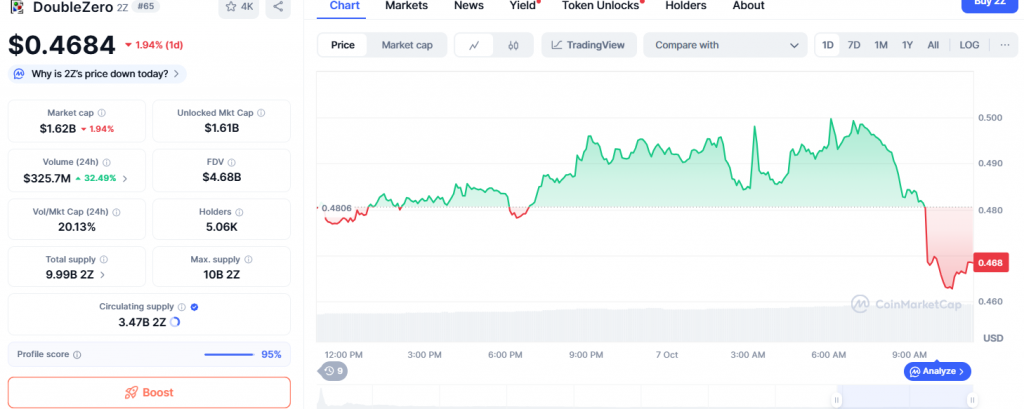

Following the DoubleZero listing news, the 2Z price reacted positively, rising 3% to trade at $0.496. Trading volume also increased by 35%, indicating renewed trader interest.

While the token has seen volatility since its debut last week, the combination of a clear regulatory path and a major exchange listing creates a strong foundation for future growth.