While the broader market experienced a pullback, Ethereum is demonstrating remarkable resilience during this Ethereum price consolidation phase. Currently trading around $4,443, ETH remains well-positioned for its next major move despite the recent 5.3% dip. The token continues to show strength, maintaining 7% weekly gains and trading just 10% below its August peak of $4,946.

Institutional Demand Absorbs Selling Pressure

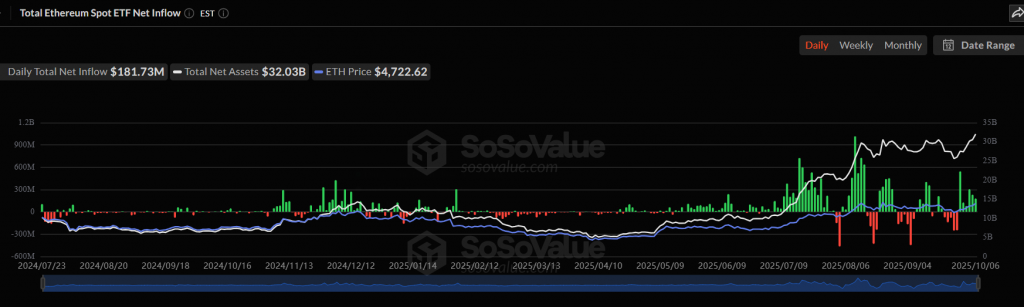

The real story behind this Ethereum price consolidation lies in the massive institutional inflows continuing to pour into spot Ethereum ETFs. SoSoValue data reveals another $420 million flowed into these funds on October 7, marking the seventh consecutive day of positive inflows. With total ETF assets now surpassing $30 billion, this consistent institutional demand creates a powerful floor beneath Ethereum’s price.

Meanwhile, exchange reserves have plummeted to a three-year low of 17.4 million ETH, down dramatically from 28.8 million in 2022. This supply squeeze is further amplified by public companies holding approximately 3.6 million ETH and the ongoing EIP-1559 burn mechanism permanently removing ETH from circulation.

Ethereum Price Technical Setup Hints at Impending Breakout

The technical picture confirms the consolidation narrative. Ethereum is trading comfortably within its Bollinger Bands, with the mid-band at $4,313 providing solid support. The RSI reading of 53 indicates perfectly balanced momentum—neither overbought nor oversold.

Trading volume has surged 27% to $51.9 billion, while futures open interest declined 5.5%, suggesting healthy leverage flush-out rather than capitulation. This combination of strong volume and decreasing open interest typically precedes significant price moves.

My Thoughts

This consolidation phase represents accumulation, not distribution. The combination of massive ETF inflows, shrinking exchange reserves, and balanced technicals creates a perfect storm for upside potential. While a break below $4,300 could test $3,900 support, the institutional bid appears strong enough to defend key levels. The path of least resistance remains upward.