A mysterious large trader known as the “Trump Insider Whale” is making massive bearish bets against Bitcoin, raising eyebrows across crypto markets. According to Arkham Intelligence data, this enigmatic trader has increased their Bitcoin short position to $340 million after previously earning approximately $200 million in profits from perfectly timed bearish positions.

Trump Insider Whale Builds Massive Short Position

The Trump Insider Whale has demonstrated remarkable market timing throughout recent volatility. Before the October 10 market crash that wiped out $19 billion, this trader had established $700 million in Bitcoin shorts and $350 million in Ethereum shorts. These positions generated enormous profits as markets collapsed.

Now, the Trump Insider Whale has deposited $40 million USDC to Hyperliquid and opened an additional $127 million Bitcoin short. Their current unrealized profit stands at $5 million, with total bearish exposure reaching $340 million specifically targeting Bitcoin. The precision of these trades has sparked speculation about potential insider information, though nothing has been confirmed.

Broader Market Faces Significant Liquidations

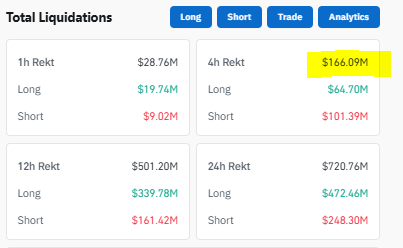

The whale’s increased shorting comes amid substantial market turbulence. Overall crypto liquidations have reached $624 million within 24 hours, affecting 213,938 traders. Ethereum long traders suffered particularly badly with $107 million in liquidations, while Bitcoin long positions saw $95 million wiped out.

Despite the aggressive short positioning, Bitcoin has shown some resilience, currently trading at $111,584 with a 2.36% daily gain. Market capitalization attempts recovery at $2.22 trillion alongside $79 billion in daily trading volume. However, the continued bearish pressure from large traders suggests underlying weakness.

My Thoughts

This whale’s consistent success in timing market downturns is both impressive and concerning. While their actions don’t necessarily predict future price direction, the scale of their positions can influence market sentiment. The fact that they’re doubling down on shorts despite recent price stabilization suggests they anticipate further downside. Retail traders should prepare for potential volatility.