The US-China tariff truce just moved from threat to negotiation — and that matters for crypto. Why? Because tariffs, export limits, and tech bans ripple through hardware supply, token flows, and global risk appetite. Traders, builders, and miners: pay attention.

What happened

President Trump said planned tariff hikes on Chinese goods were “unsustainable.” He flagged that the dramatic rate increases, once threatened to reach as high as 145%, could hurt the broader economy. Yet, talks continue. Trump and Treasury Secretary Scott Bessent signaled progress and hope that a face-to-face with Xi could cool tensions. Meanwhile, China tightened rare-earth export rules — a direct supply shock for chip and miner supply chains. Also, a temporary 90-day ceasefire is set to expire on November 10, after Trump floated a possible extra 100% tariff by November 1.

Market mechanics — short explainer

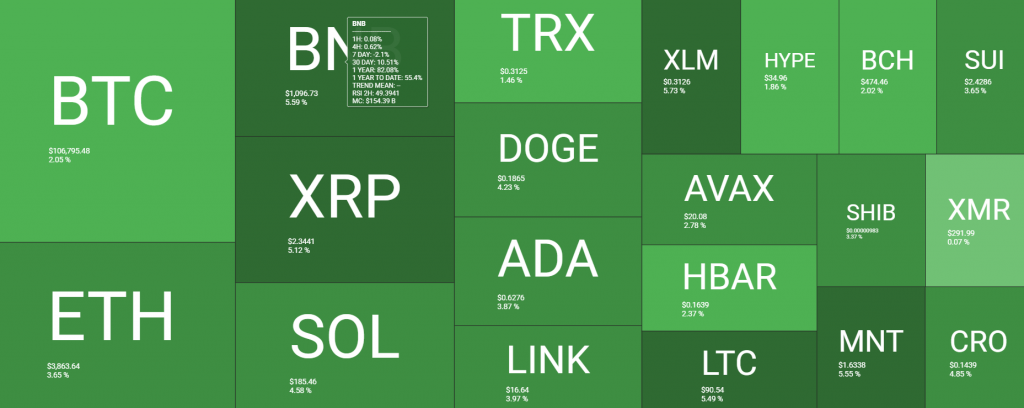

First, hardware risk: rare earths affect ASICs and chip manufacturing. If supply tightens, mining rigs and on-chain security could face higher costs. Second, liquidity and flows: headlines drive risk-on/risk-off moves. Crypto often leads risk assets; expect volatility, especially in BTC, large-cap altcoins, and crypto equities. Third, DeFi & cross-border payments: trade friction pushes people toward tokenized settlements and stablecoins as hedges.

Actionable alpha

Rebalance exposure ahead of key dates. Hedge hardware and miner bets. Watch stablecoin flows and on-chain OTC volumes for early signs of capital rotation.

My Thoughts

This is a short-term headline play with longer structural implications. If talks hold, risk assets rally. If not, expect a hardware squeeze and flight to on-chain hedges.