The institutional toolbox for Solana just expanded dramatically. Grayscale has officially launched Solana ETF options trading for its GSOL fund, marking a pivotal moment for professional investors seeking exposure to the ecosystem.

Institutional Milestone: Grayscale Launches Solana ETF Options Trading

This groundbreaking development allows for sophisticated strategies like hedging, income generation, and leveraged bets on SOL’s price movement without directly holding the asset. The move, announced just two weeks after the fund’s debut, signals that demand for complex Solana-based financial products is already surging and that the market is maturing at a breathtaking pace.

Why Solana ETF Options are a Game-Changer

The introduction of Solana ETF options is about more than just another trading product; it’s about providing institutional-grade risk management and strategic flexibility. Options allow large funds to protect their positions (hedge), generate yield by selling contracts, and make targeted bets on volatility. Furthermore, the GSOL ETF itself is uniquely structured with a 0% management fee and incorporates 100% staking, passing on over 7% in annual rewards to investors. This combination of fee-free exposure, staking yield, and now options trading creates a complete, powerful investment vehicle that directly competes with traditional financial products.

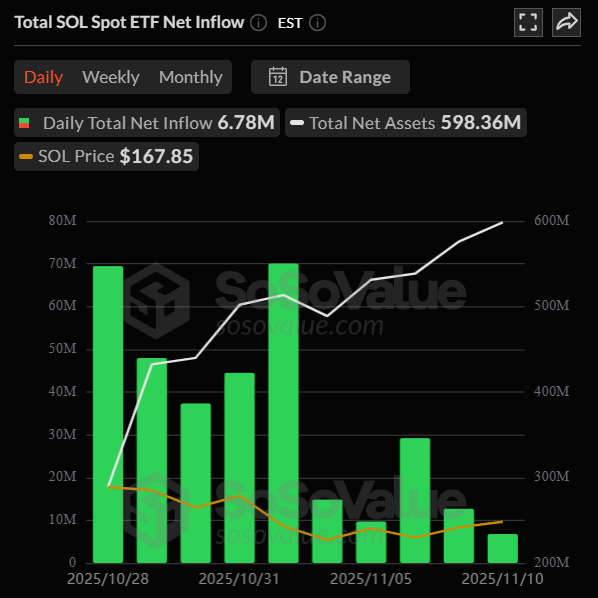

The Proof is in the Flows: A 10-Day Institutional Inflow Streak

This innovation comes as institutional confidence in Solana hits a new high. Spot Solana ETFs have now recorded an impressive ten consecutive days of net inflows, bringing the total haul to $342.48 million since their launch on October 28. This relentless accumulation occurred even as SOL’s price corrected over 18% in the past month, proving that smart money is using the dip to build long-term positions. The demand starkly contrasts with quieter Ethereum ETFs, which saw zero flows on the same day, highlighting a clear capital rotation into the Solana ecosystem.

The Bigger Picture: Solana’s Fundamentals Remain Strong

Beyond the financial products, Solana’s underlying network health is undeniable. The ecosystem boasted over 3.2 million active wallets and processed a staggering ~70 million daily transactions in October. This high engagement level demonstrates robust utility that exists independently of short-term price action. The sustained ETF inflows and the launch of Solana ETF options suggest that institutions are betting on this fundamental strength for the long haul, viewing the current price volatility as a strategic entry point.

My Thoughts

This is a watershed moment for Solana’s legitimacy in traditional finance. The rapid succession of the ETF launch followed by options trading shows that Wall Street isn’t just dipping a toe—it’s diving in headfirst. The consistent inflows are the ultimate vote of confidence. I believe this institutional scaffolding will provide a solid foundation for the next leg up, potentially decoupling SOL from broader market weakness. The Solana ETF options launch is a clear alpha signal.