The dam has broken. In a brutal wave of selling, the Bitcoin price crash intensified, sending BTC plummeting to $98,573 and decisively shattering the critical $100,000 support level.

Blood in the Streets: Bitcoin Price Crash Below $100K Triggers $709M Liquidation Carnage

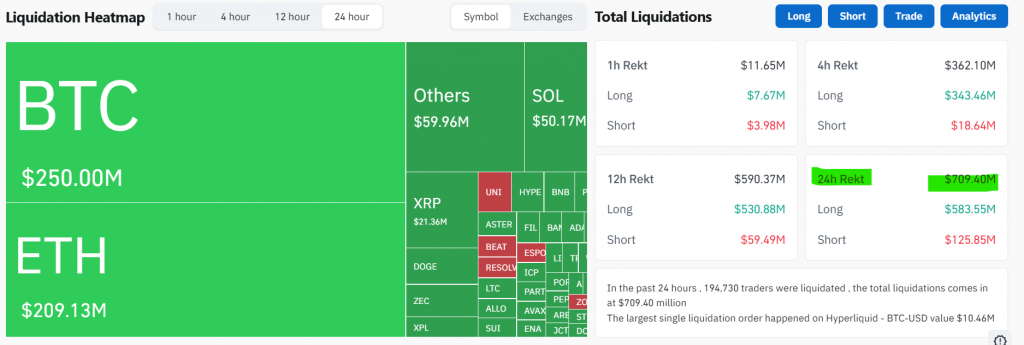

This collapse triggered a liquidation bloodbath, wiping out $709.’ million from leveraged traders across the market within 24 hours. A staggering $583 million of that total came from vaporized long positions, as bulls who bet on the $100K floor were utterly annihilated. This marks the third time BTC has traded below $100,000 in November, confirming a severe 22% correction from its October high and ending a historic 189-day streak of closes above that psychological level.

Behind the Bitcoin Price Crash: US Selling and ETF Outflows

So, what fueled this violent move? On-chain data points directly to a resurgence of selling pressure from the United States. Analyst Satoshi Stacker highlighted that the “Coinbase $BTC discount indicates that US-based selling has reaccelerated,” meaning American investors were offloading coins at a lower price than on other global exchanges. This selling was likely compounded by ongoing redemptions from spot Bitcoin ETFs, creating a perfect storm of institutional and retail capitulation. The $100,000 level, which had acted as a massive liquidity pool, transformed from support into resistance, accelerating the downward spiral.

Market-Wide Carnage and Trader Sentiment

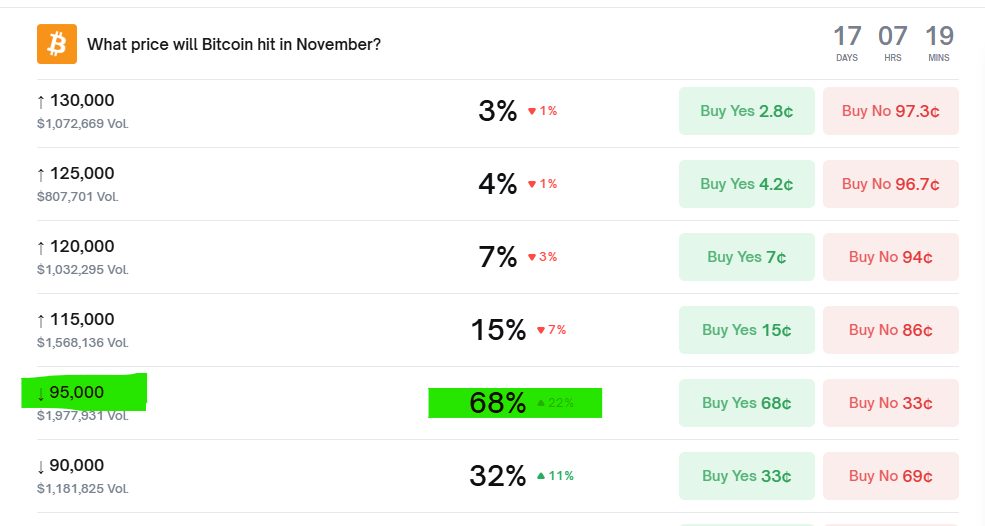

The pain was felt across the entire crypto board. Ethereum dropped to $3,168, Solana crumbled to $141, and XRP slid to $2.82. The scale of the long liquidations marks one of the largest forced closure events in Q4 2025. The sentiment among prediction markets has turned deeply bearish, with Polymarket traders assigning a 68% probability that Bitcoin will fall to $95,000 before the month ends. This Bitcoin price crash has clearly shaken trader confidence, with many now bracing for more downside.

What’s Next? The Battle for the Next Support Level

With the $100,000 support conclusively broken, the next major line in the sand is the $95,000 level. A break below that could open the door for a deeper correction. For any hope of a reversal, bulls must now reclaim $100,000 as support—a task that will require significant buying pressure to absorb the remaining sell orders. Until then, the path of least resistance remains downward. This Bitcoin price crash is a stark reminder of the market’s volatility and the dangers of over-leverage.

My Thoughts

This is a painful but necessary cleanse. The market was over-leveraged and overly reliant on the $100K support. This flush, while brutal, removes weak hands and creates a healthier foundation for the next leg up. I’m watching for signs of seller exhaustion and a reclaim of $100K. For long-term believers, this is a potential accumulation zone, but caution is warranted until volatility subsides and a clear bottom is formed.