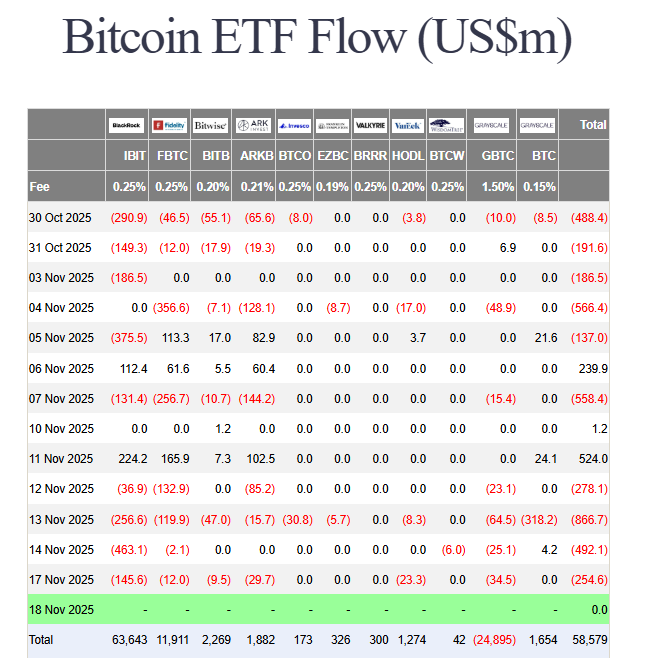

Bitcoin ETF Outflows Continue with $254M Bleed as Price Tests $91K

The pressure on Bitcoin is intensifying. For the fourth consecutive day, Bitcoin ETF outflows have hammered the market, with a net $254.6 million exiting these institutional products on November 17 alone. BlackRock’s IBIT led the exodus with $145.6 million in net outflows, contributing to a brutal sell-off that pushed BTC as low as $89,300 today before a slight rebound to $93,300. The premier cryptocurrency is now down over 12% for the week and a staggering 28% from its all-time high, signaling a deep correction is underway.

A Critical Break: BTC Drops Below the 2025 Realized Price

The situation grows more serious when looking at on-chain metrics. Bitcoin has now decisively broken below the 2025 realized price of $103,227. This key metric represents the average price at which all coins bought this year were acquired. This break means the average buyer from 2025 is now sitting on a 13% loss. Historically, this is a significant psychological level. While alarming, data from Glassnode shows that such breaks have often presented prime accumulation opportunities throughout the cycle. We saw similar dynamics during the March 2023 banking crisis and the August 2024 Yen carry trade unwind, which both ultimately proved to be fantastic buying zones.

Historical Context: How This Correction Compares

This current downturn is now 43 days old, placing it on a similar trajectory to the April 2025 correction, which saw price fall from $109,000 to $76,000. However, that correction lasted 80 days—nearly twice as long as the current one. This suggests that while the pain is severe, we may only be halfway through this corrective phase if history rhymes. The relentless Bitcoin ETF outflows are the primary driver, creating a negative feedback loop of selling pressure.

My Thoughts / Market Impact

This is a brutal but necessary flush. The ETF flow data is ugly, but it’s revealing a cleansing of weak-handed institutional capital. The break below the realized price is intimidating, yet history shows this is precisely when long-term investors should pay attention. We are likely in the “capitulation” phase. For those with dry powder, this is not a time for panic, but for disciplined, gradual accumulation. The fundamentals haven’t changed; only the price has.