Bitcoin Price Rebound Ignites as Institutional Flows Return

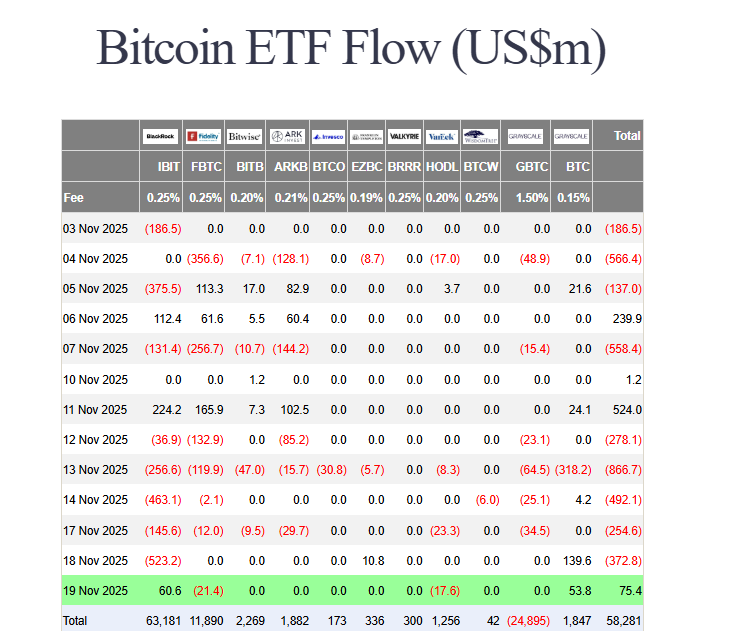

After a brutal week of selling pressure, the Bitcoin price rebound is finally showing concrete signs of life. BTC is up nearly 2% in the past 24 hours, stabilizing around $92,000 and helping the overall crypto market cap push into the green. Most importantly, U.S. spot Bitcoin ETFs have broken a painful five-day outflow streak, posting a net inflow of $75.47 million. This suggests institutional buyers are cautiously returning, providing much-needed support for this tentative Bitcoin price rebound.

Institutional Bullishness Defies the Fear

The institutional conviction runs deeper than just ETF flows. Abu Dhabi’s sovereign wealth fund (ADIC) dramatically increased its stake in BlackRock’s IBIT ETF in Q3, boosting its holdings from 2.4 million to nearly 8 million shares—a position worth roughly $520 million. This is a powerful vote of confidence from a traditional finance titan. Furthermore, a landmark development in New Hampshire saw the approval of the first-ever municipal bond backed by Bitcoin. This could pave the way for digital assets to enter the massive $140 trillion global debt market, opening a entirely new frontier for adoption.

The Bull vs. Bear Battle Rages On

Despite the green shoots, experts remain divided. On the bull side, voices like Bitwise CIO Matt Hougan urge investors to focus on Bitcoin’s long-term utility rather than short-term swings. Michael Saylor continues to preach an “indestructible” thesis, with his firm Strategy consistently buying more BTC. However, bears have compelling arguments. Veteran trader Peter Brandt warns that a bearish “broadening-top” pattern could project a downside target as low as $58,000. Additionally, a strengthening U.S. dollar and the Fed’s potential to hold rates steady create persistent macro headwinds for risk assets like Bitcoin.

My Thoughts

This is the messy, volatile process of a market finding its bottom. The return of ETF inflows and sovereign accumulation is incredibly bullish for the medium term. However, the technical damage can’t be ignored. I believe the institutional bids are creating a floor. While another leg down is possible, the risk-reward for accumulation at these levels is becoming increasingly attractive for long-term holders.