Fed Rate Cut Bets Soar, Fueling Critical Bitcoin Rebound

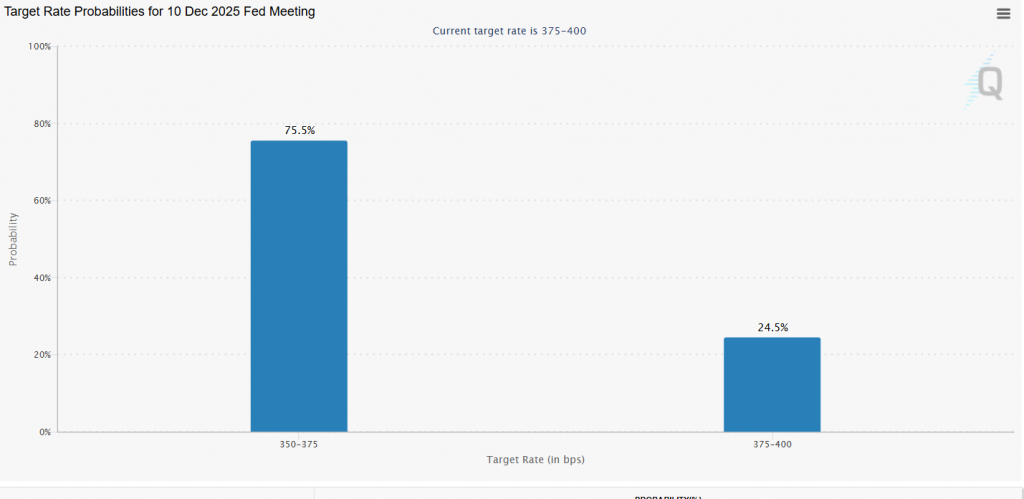

The macro winds are shifting in crypto’s favor. According to Barclays Research, Fed Chair Jerome Powell may personally push for another Fed rate cut in December, creating a potential game-changer for risk assets like Bitcoin. This comes as the CME FedWatch Tool shows odds for a 25 bps cut have skyrocketed from 33% to over 75% in recent days. The mere anticipation has already helped BTC rebound over 8% from last week’s lows, pushing it past $86,000 and igniting hopes for a sustained recovery.

Inside the Fed’s Divided Stance

The path to a Fed rate cut is a heated battle. Barclays analysis reveals a deeply divided FOMC. Governors like Stephen Miran and Christopher Waller appear to support a cut, while others like St. Louis Fed President Alberto Musalem lean toward holding steady. The influential “Wall Street Journal Fed Whisperer” Nick Timiraos believes a cut won’t happen “unless Powell forces it,” putting immense weight on the Chairman’s influence. Meanwhile, Treasury Secretary Scott Bessent has dismissed inflation and recession fears, removing a potential argument against easing monetary policy. This creates a perfect narrative for a market hungry for liquidity.

Bitcoin’s Technical Path to $90K

This macro tailwind is supercharging Bitcoin’s technical setup. The rebound has been backed by a 45% surge in trading volume, confirming genuine buyer interest. Analysts are now mapping the path forward. Popular trader Michael van de Poppe identifies a key CME gap at $85.2K, suggesting a possible brief pullback to that level before a resumption of the rally toward $90K-$96K. Similarly, Rekt Capital notes that a weekly close above $86K could pave the way for a test of $93K. The convergence of a potential Fed rate cut, spot ETF inflows, and bullish technicals creates a powerful recipe for further gains.

My Thoughts

This is the macro catalyst we’ve been waiting for. A potential December Fed rate cut is the ultimate liquidity injection, and Bitcoin is the prime beneficiary. The timing is perfect, aligning with year-end institutional positioning and persistent ETF demand. While the Fed decision is still a close call, the market is now pricing in the optimism. I believe this sets up a powerful year-end rally, with $90K as the first stop and new all-time highs potentially in sight for Q1 2026.