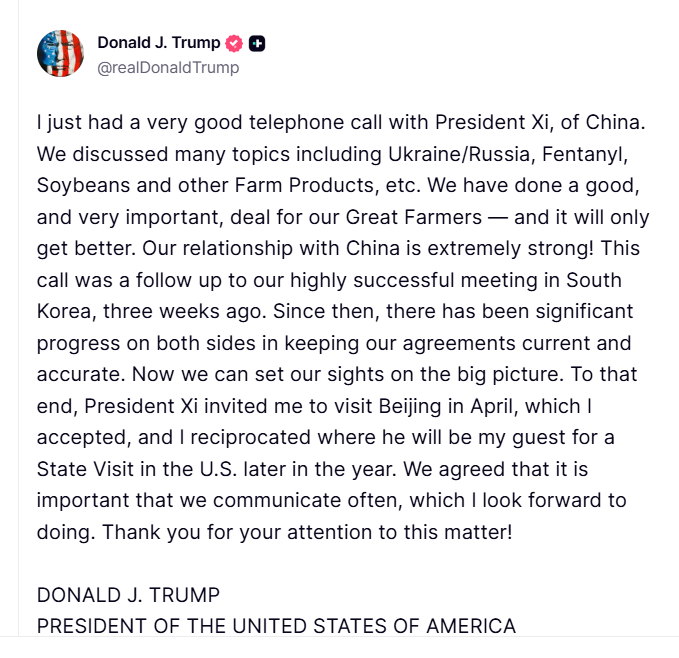

Bitcoin is heating up again as today’s Trump-China call injected fresh optimism into global markets. President Donald Trump said the U.S. and China maintain an “extremely strong” relationship following his conversation with President Xi Jinping — a sharp contrast to the tariff threats that rocked crypto earlier this month.

BTC pushes past $88K

TradingView data shows BTC ripped above $88,000, tagging an intraday high near $88,400. That’s almost a 2% surge from its $85,000 low just hours earlier. The move came right after Trump posted on Truth Social, praising his dialogue with Xi and celebrating the progress made since their “highly successful” South Korea meeting.

Investors are reading this as a strong sign the U.S.–China trade truce is holding. This is critical, because Trump’s earlier threat of 150% tariffs on Chinese imports triggered a market-wide crash. Now, risk appetite is returning — and Bitcoin is usually the first to react.

BTC eyes the $90K breakout

As Bitcoin climbs, traders are asking the big question: Is the bottom finally in? BitMEX founder Arthur Hayes thinks so. Earlier this month, he said BTC’s drop below $100,000 likely marked a cycle low, especially as global liquidity begins to improve.

Hayes expects the Fed to end quantitative tightening on December 1, injecting fresh USD liquidity into markets. Banks also boosted lending in recent weeks, another bullish macro signal.

Macro strategist Julien Bittel added that as the U.S. expands its debt to keep GDP growing, more capital will inevitably flow into markets. In a world of perpetual currency debasement, he says, Bitcoin thrives — acting as the hardest asset in the system.

If momentum holds, analysts expect BTC to retest the $90K level quickly and possibly push higher before month’s end.

My Thoughts

This rally isn’t random — it’s liquidity plus geopolitics. As long as the Trump-China call signals stability and the macro picture keeps easing, BTC could break $90K faster than most expect. Watch liquidity flows, not fear-driven headlines.