Ethereum Futures Leverage Explodes to Q4 High as Traders Bet on Volatile Breakout

The smart money is placing massive bets on an Ethereum explosion. Fresh data reveals a dramatic surge in Ethereum futures leverage, with the futures-to-spot ratio on Binance rocketing to 6.84—its highest level this quarter. This significantly outpaces Bitcoin and Solana, signaling that traders are aggressively using derivatives to position for a major ETH move. As the price consolidates above the critical $3,000 level, this buildup of speculative pressure is creating a coiled spring, ready to launch a powerful rally or trigger a violent liquidation cascade.

The Technical Battlefield: Can ETH Hold $3,000?

The explosion in Ethereum futures leverage comes as ETH tests a make-or-break technical zone. Analysts are deeply divided on the next move. On the bull side, trader Scient points to a reinforced 4-hour support base at $2,800, suggesting any dip to this level would attract buyers and set the stage for a push toward $3,050. The ultimate target for bulls is the $3,390 liquidity cluster, a zone packed with technical significance. However, bears like Ken from Lab Trading warn that ETH has consistently been rejected by the 4-hour, 100-EMA throughout November. Their thesis is simple: if $3,000 fails to flip into solid support, a sharp downside extension is likely.

Bullish Tailwinds: ETF Inflows and the “Santa Rally” Narrative

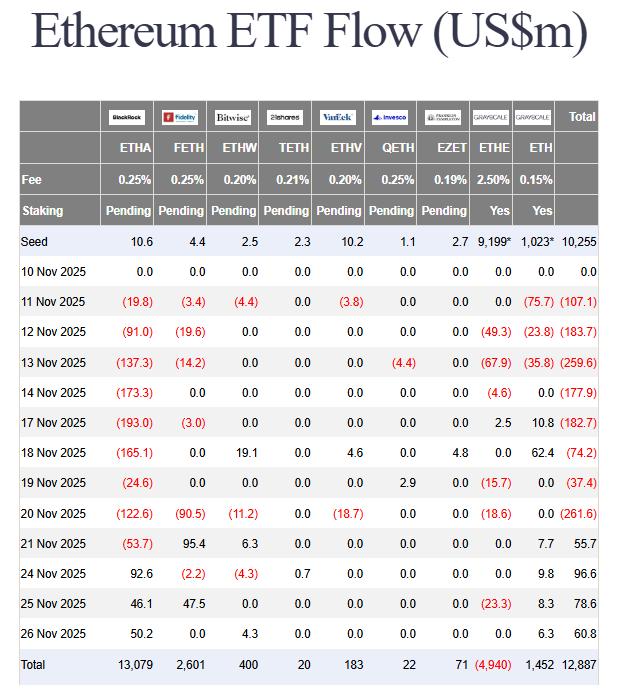

The leverage frenzy isn’t happening in a vacuum. It’s supported by a fundamental shift: U.S. spot Ethereum ETFs have notched four consecutive days of net inflows, including a strong $60.8 million on November 26, led by BlackRock. This provides a solid institutional bid beneath the market. Furthermore, analysts are beginning to whisper about a potential “Ethereum Santa Rally.” Kingpin Crypto notes that ETH is reacting off a key 0.618 Fibonacci retracement level, with multiple higher-timeframe supports below, creating a perfect setup for a year-end surge toward $3,300, especially if Bitcoin’s market dominance continues to weaken.

My Thoughts

This surge in Ethereum futures leverage is a double-edged sword. It shows immense conviction but also creates a fragile, over-leveraged market. A clean break above $3,050 could trigger a massive short squeeze and fuel a rapid move to $3,400. However, a rejection could liquidate these long positions just as quickly, causing a sharp dip. The ETF inflows are the stabilizing force that makes me lean bullish. I believe the market is underestimating the potential for a coordinated gamma squeeze if positive momentum continues.