Dogecoin ETF Inflows Quietly Build as Price Rebounds 6.5% from Lows

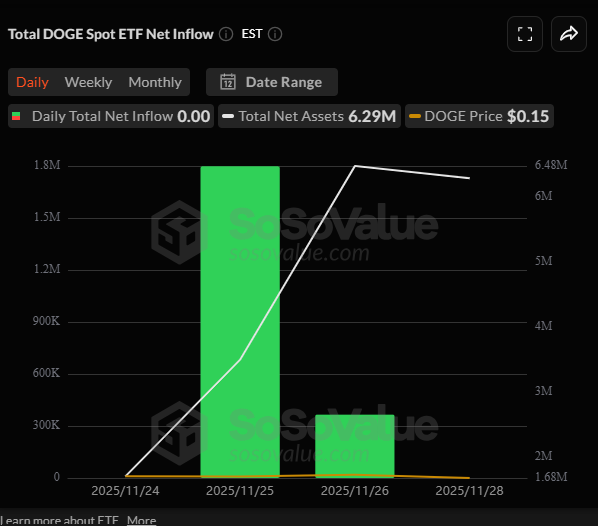

The original memecoin is showing fresh signs of life. Dogecoin has mounted a solid 6.5% weekly rebound, pushing its price to $0.1481 after a brutal 22% monthly decline. While this bounce is catching eyes, the real story is happening beneath the surface: the nascent Dogecoin ETF inflows are steadily accumulating, with Grayscale’s GDOG and Bitwise’s GWOW funds collectively pulling in nearly $2 million. This institutional interest, though modest compared to Bitcoin’s massive flows, is providing a fundamental anchor for DOGE during a turbulent market.

Key Technical Levels: The Path to a 430% Rally

According to prominent analyst Ali Martinez, DOGE’s entire future hinges on two simple price zones. Strong support sits at $0.08, a level where a massive cluster of investors originally bought in. The major resistance, however, is at $0.20—a wall of supply held by long-term holders. The current price is stuck in the wide mid-range between these two points. The weekly chart reveals a large descending structure, but the Bollinger Bands are compressing, and the RSI has room to run, suggesting energy is building for a significant move. Analysts at Bitcoinsensus point to a repetitive cycle where accumulation phases lead to explosive waves. If this pattern holds, a breakout above $0.20 could trigger a staggering 430% rally toward $0.80.

Can Dogecoin ETF Inflows Trigger the Next Wave?

While the Dogecoin ETF inflows of $2 million seem small, their existence is what matters. They represent a new, non-cyclical source of demand that didn’t exist before. For a meme coin, this is a monumental step toward legitimacy. The inflows have been inconsistent—$1.8 million on November 25, $365k on November 26, and zero on November 28—but the foundation is being laid. As long as DOGE holds above the critical $0.08 support, the technical setup suggests that the current consolidation is a giant coiling process. A decisive break above the long-term trendline and the $0.20 resistance would be the ultimate confirmation that the next mega-wave is beginning.

My Thoughts

Don’t sleep on Dogecoin. The combination of steady ETF accumulation and a coiled technical spring is dangerously bullish. While the ETF flows are a trickle now, they prove that institutional plumbing exists for DOGE. When the broader meme coin narrative returns—and it always does—this infrastructure will allow capital to flood in at an unprecedented speed. The risk/reward here is asymmetric; a drop below $0.08 would be painful, but a breakout above $0.20 could be historic.