Strategy’s Bitcoin Purchase Continues Unshaken Amid Market Fear

While the market panics, Michael Saylor’s Strategy is executing with machine-like precision. The company has announced another Bitcoin purchase, acquiring 130 BTC for $11.7 million at an average price of $89,960. This latest buy brings its monumental treasury to 650,000 Bitcoin, acquired at an average cost basis of $74,436. The move comes as the Fear & Greed Index plunges to a fearful 20 and BTC price battles below $90,000, proving that true conviction operates on a different timeline than market sentiment.

A Strategic USD Reserve for Dividend Safety

In a masterclass of corporate treasury management, Strategy also announced the establishment of a $1.44 billion USD reserve. This fund, raised through an at-the-market (ATM) equity offering—not by selling Bitcoin—is designed to cover at least 12 months of preferred stock dividend payments and interest on debt. This move directly addresses critics like Peter Schiff and proactively mitigates risk. CEO Phong Le had previously stated that selling BTC would be a “last resort,” and this reserve ensures the company can uphold its obligations while protecting its core Bitcoin holdings, with plans to expand the reserve to cover 24 months.

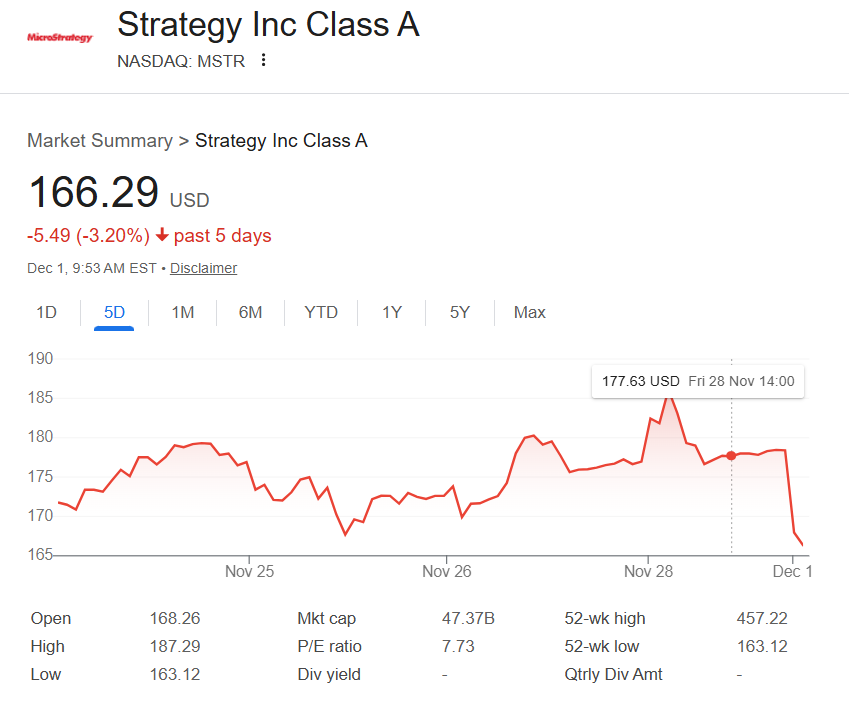

MSTR Stock Diverges From Bitcoin Purchase Strategy

Interestingly, the market is punishing the messenger while ignoring the message. Despite this disciplined Bitcoin purchase and prudent financial planning, MSTR stock is down over 5% in premarket trading. This creates a stark divergence: the company’s strategy is clear and bullish, but its stock price is being dragged down by broader crypto market fears. This disconnect may represent a potential opportunity, as the company’s fundamental actions—accumulating BTC and securing its balance sheet—remain overwhelmingly positive.

My Thoughts

This is the ultimate “strong hands” behavior. While weak holders sell in panic, Saylor’s firm is systematically buying and fortifying its financial position. The USD reserve is a genius move that silences critics and secures the runway. The stock sell-off is a short-term emotional reaction. For long-term investors, these actions confirm that Strategy is the most disciplined corporate holder in crypto. This is not trading; this is sovereign-grade treasury management. When the market eventually turns, their positioning will look prescient.