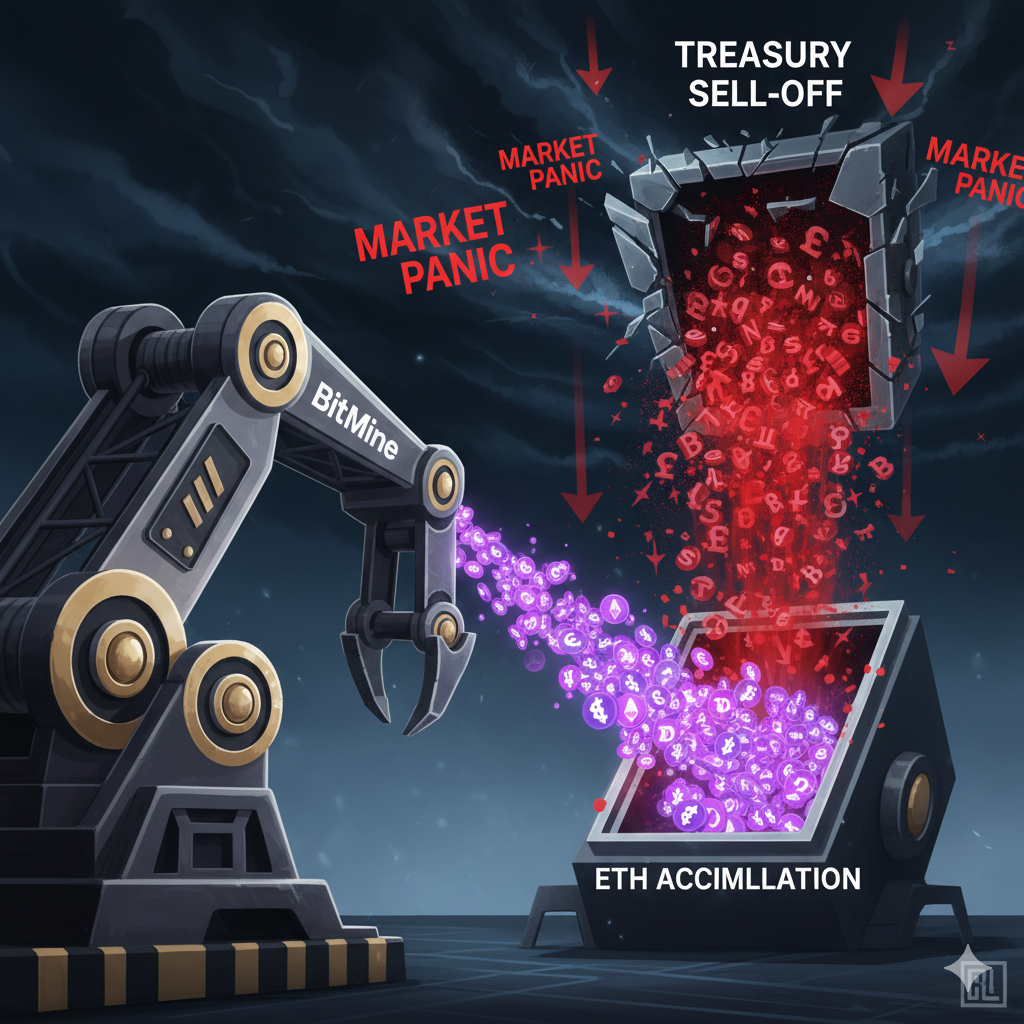

BitMine’s Bold Ethereum Accumulation Defies Widespread Treasury Panic

While other corporate treasuries are hitting the sell button in a panic, one giant is doubling down. BitMine Immersion Technologies has executed another massive Ethereum accumulation, purchasing 96,798 ETH last week alone. This fearless move expands its total holdings to a staggering 3.73 million ETH, worth approximately $10.5 billion, even as the broader market crashes. Amid an environment where most digital asset treasuries are de-risking or selling to protect their balance sheets, BitMine’s aggressive buying streak stands out as a monumental vote of confidence in Ethereum’s long-term future.

BitMine’s Ethereum Accumulation vs. The Treasury Exodus

BitMine’s latest Ethereum accumulation comes at a critical moment. Across the sector, companies are pausing purchases or selling holdings to narrow the discount between their stock price and net asset value (NAV). This widespread retreat highlights the severe pressure on crypto balance sheets. In stark contrast, BitMine is accelerating its buying, increasing its weekly purchase volume by 39%. Chairman Thomas Lee directly tied this strategy to the upcoming Fusaka upgrade on December 3, which aims to significantly boost Ethereum’s scalability and security. Lee also cited a stabilizing market and anticipated Federal Reserve policy shifts as tailwinds.

The High-Stakes Bet on Ethereum’s Future

This accumulation is a high-conviction, high-risk bet. BitMine reportedly faces over $4 billion in unrealized losses on its Ethereum position. Despite this, the firm is choosing to back its long-term thesis rather than capitulate to short-term fear. This monumental Ethereum accumulation is a strategic bet on three converging factors: the transformative potential of the Fusaka upgrade, a more favorable macro environment post-Fed meeting, and Ethereum’s fundamental role in the future of decentralized finance. While BitMine’s own stock (BMNR) fell 7.7% in premarket trading following the news, their actions speak to a vision measured in years, not days.

My Thoughts

This is the ultimate “be greedy when others are fearful” play. BitMine isn’t just trading; it’s strategically positioning itself to own a foundational piece of the next internet. Their relentless Ethereum accumulation during a fire sale could give them an unrivaled advantage in the next cycle. While painful in the short term, this level of conviction from a multi-billion dollar entity often marks a major turning point. They are effectively setting a price floor and signaling to the market that current levels are a generational buying opportunity.