Bitcoin Trader Sentiment Hits Critical Extreme: Is This The Capitulation Signal?

A critical shift in Bitcoin trader sentiment is flashing a potentially major signal. Data reveals that short-term BTC holders are now sitting on the steepest unrealized losses of this entire bull cycle. Historically, this level of concentrated pain often precedes a significant trend reversal, making this a pivotal moment for the market.

Short-Term Holders Reach Peak Pain

According to CryptoQuant analysis, traders who bought Bitcoin within the last one to three months are holding bags with 20-25% unrealized losses. This cohort has been underwater for over two weeks, marking the most severe drawdown for this group in the current cycle. This is a classic sign of a capitulation zone. As these discouraged sellers finally exit their positions, they provide the final wave of sell-side liquidity, often clearing the path for a new bullish leg. The key level to watch for their relief is Bitcoin’s short-term holder realized price near $113,692.

Institutions See Opportunity, Not Doom

While retail sentiment sours, major institutions are seeing a clear opportunity. Asset manager Grayscale recently stated that this drawdown points to a local bottom, potentially ahead of a strong recovery in 2026. This perspective challenges the old “four-year cycle” theory, suggesting a new, institutionally-driven market structure is at play.

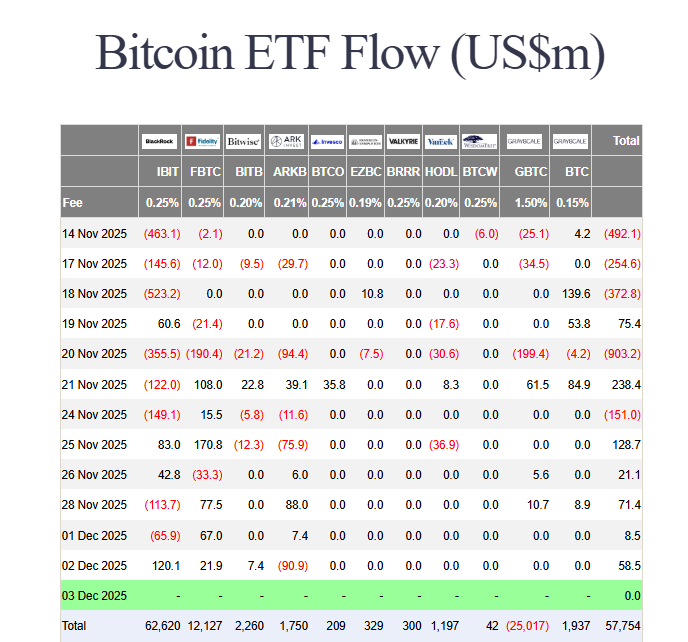

ETF Data Tells a Different Story

Contrary to popular belief, spot Bitcoin ETFs have been a minor contributor to recent selling pressure. Bloomberg analyst Eric Balchunas noted ETFs accounted for only about 3% of total selling. The narrative is now flipping, with ETFs seeing five consecutive days of net positive inflows. Crucially, Bitcoin’s price has risen back above the average cost basis for ETF buyers ($89,600), meaning the majority are no longer at a loss, which could stabilize and attract further inflows.

My Thoughts

This is where smart money separates from emotional money. The extreme negative Bitcoin trader sentiment among short-term holders is precisely the contrarian signal large investors watch for. When the “weak hands” are finally shaken out, the asset can advance on a stronger foundation. With ETF flows turning positive and institutional outlooks bullish, this period of maximum pain likely sets the stage for the next major rally. The $90k-$94k zone is now the critical battleground.