Bitcoin ETF Inflows Stay Positive Despite Market Turbulence

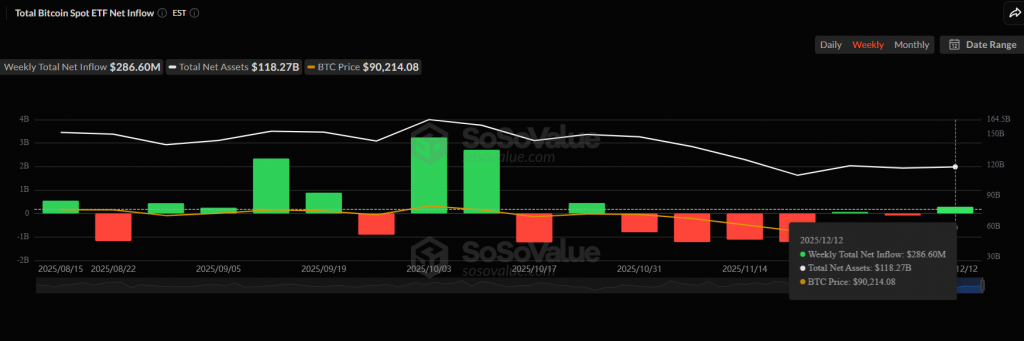

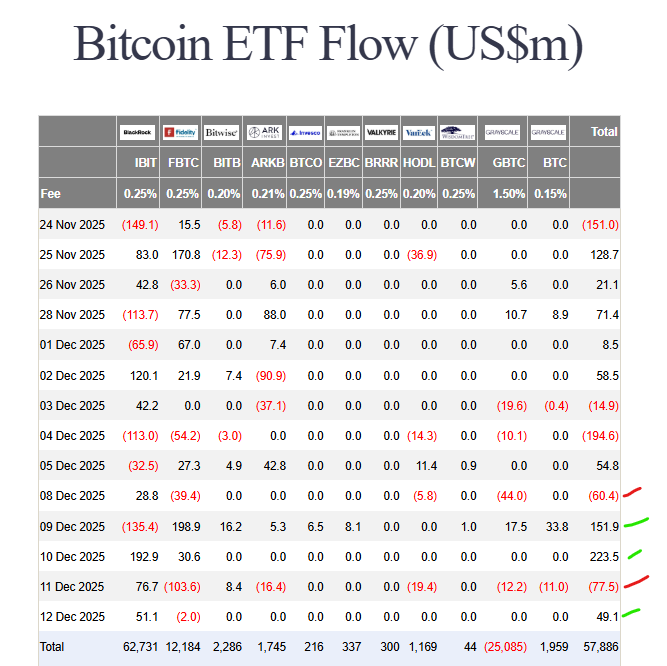

Despite a volatile week for crypto markets, Bitcoin ETF inflows remain resilient. On December 12, U.S. spot Bitcoin ETFs recorded $49.1 million in net inflows, pushing the weekly total to a positive $286.60 million, even as Bitcoin’s price faced notable downside pressure.

This divergence between ETF flows and price action highlights continued institutional demand for Bitcoin during periods of uncertainty.

Weekly Bitcoin ETF Inflows Defy Market Volatility

The positive Bitcoin ETF inflows come during a week marked by heightened volatility, macro uncertainty, and cautious market sentiment. While short-term traders reacted to price movements, ETF investors continued to allocate capital into Bitcoin exposure through regulated investment vehicles.

Maintaining positive weekly inflows during turbulent conditions suggests that long-term conviction remains intact among institutional and professional investors.

Bitcoin Price Pulls Back Below $90K

While ETF flows stayed strong, Bitcoin price action moved in the opposite direction. BTC dropped sharply from $93,000 to $89,000, before stabilizing and currently trading around the $90,000 level.

Such price pullbacks are not uncommon during consolidation phases, especially after extended periods of elevated volatility. Historically, sustained ETF inflows during price dips have often preceded periods of renewed upside momentum.

What Bitcoin ETF Inflows Signal Going Forward

The persistence of Bitcoin ETF inflows during price weakness may indicate accumulation rather than distribution. Institutional investors often use pullbacks to build exposure, particularly when macro conditions remain uncertain and liquidity tightens across risk assets.

If ETF inflows continue while Bitcoin holds key psychological levels, it could support a stronger base for future price recovery.

Final Thoughts

Even as Bitcoin price retraces, Bitcoin ETF inflows remain positive, reinforcing the narrative that institutional interest has not faded. With $286.60M in weekly net inflows, ETFs continue to play a crucial role in absorbing selling pressure and supporting long-term market structure.