Solana ETF Outflows Begin as Institutional Sentiment Turns Cautious

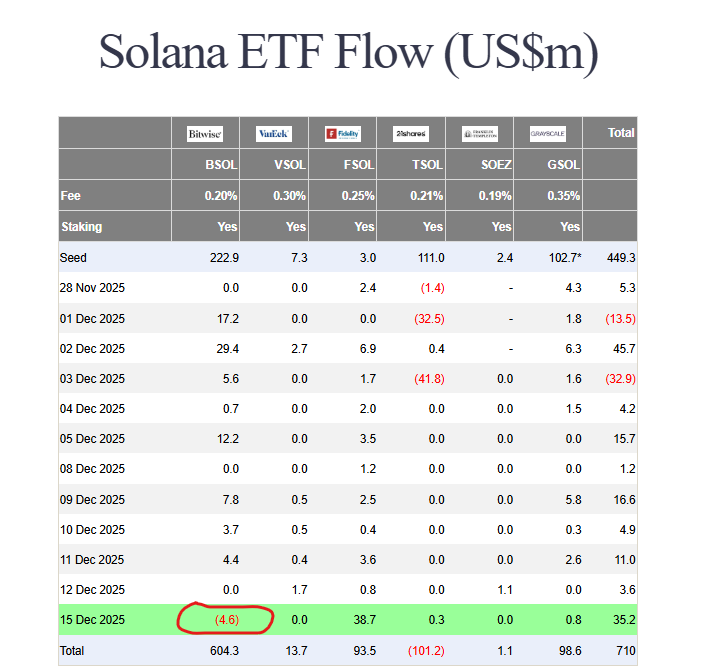

A key pillar of institutional demand for Solana has shown its first crack. The Bitwise Solana Staking ETF (BSOL) recorded its first-ever daily outflow of $4.6 million, breaking a steady inflow streak since its October launch. This shift in sentiment, likely driven by macro fears ahead of the Bank of Japan’s rate decision, contributed to a sharp 6% SOL price decline, dragging the token toward critical support near $124.

Institutional Demand: A Mixed and Cautious Picture

The BSOL outflow signals a moment of institutional caution or profit-taking. However, the broader Solana ETF picture remains nuanced. While Bitwise saw outflows, Fidelity’s Solana ETF (FSOL) attracted $38.7 million—its largest daily inflow yet. This split indicates that while some capital is rotating, overall institutional interest hasn’t collapsed. The market is now watching to see if this is a one-off adjustment or the start of a broader pullback in ETF demand.

Price and Derivatives: A Market Under Pressure

SOL price reacted negatively, breaking below $130 to trade around $126. The derivatives market reflected the fear, with total SOL futures open interest dropping nearly 2% in a short period, indicating traders are closing leveraged positions. Analysts note SOL is now trapped between $145 resistance and $124 support. A break below $124 could trigger significant liquidations and a test of lower levels, while a hold above it is crucial for any near-term recovery attempt.

Long-Term Catalysts vs. Short-Term Fear

Despite the short-term pressure, development continues. Ondo Finance announced plans to expand to Solana in early 2026, bringing tokenized real-world assets (RWAs) like stocks and bonds to the network. This highlights the ongoing institutional build-out on Solana, a bullish long-term counterpoint to current price action. Additionally, the impending launch of CME’s spot-quoted Solana futures will provide another regulated gateway for institutional capital.

My Thoughts

This is a healthy, if painful, recalibration. The first ETF outflow was inevitable after a strong run; it doesn’t mean the institutional thesis is broken. The simultaneous large inflow into Fidelity’s product shows demand is fragmented, not gone. The real test is the $124 support. If it holds and ETF flows stabilize, this dip could be a buying opportunity ahead of major catalysts like Ondo’s expansion. However, a breakdown below $124 in a risk-off macro environment could lead to a deeper correction.