Institutional Sentiment Shifts as Ethereum ETF Outflows Continue

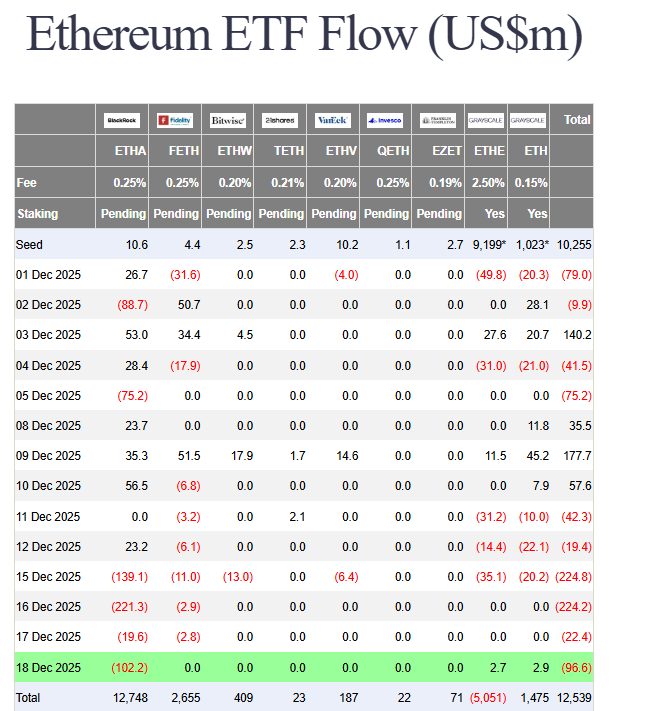

The data is clear: institutional investors are taking a brief pause. Ethereum spot ETFs have now seen net outflows for six consecutive days, with a total of $96.6 million exiting on the latest trading day. This trend of Ethereum ETF outflows signals a cooling risk appetite amidst current market volatility, but the deeper story reveals a more complex and ultimately bullish long-term picture.

Breaking Down the Latest Ethereum ETF Outflows

BlackRock’s ETHA fund led the single-day exodus with a substantial $102 million outflow. However, context is crucial—this fund still boasts a massive historical net inflow of $12.75 billion. This indicates that recent moves are likely short-term profit-taking or portfolio rebalancing, not a loss of faith in the asset.

Interestingly, not all flows were negative. Grayscale’s Ethereum Mini Trust (ETH) saw a $2.89 million inflow, showcasing that selective buying continues even during a broader pullback. The total net asset value for all Ethereum ETFs remains strong at $17.07 billion, representing over 5% of ETH’s total market cap—a significant foothold for institutional capital.

Short-Term Caution vs. Long-Term Conviction

Experts rightly point to macroeconomic uncertainty and price fluctuations as the drivers behind this short-term caution. Investors are de-risking ahead of key economic data and holiday liquidity crunches.

However, the foundational thesis remains intact. Cumulative net inflows since launch stand at a robust $12.52 billion. This proves that the initial wave of institutional adoption has created a durable base. The current Ethereum ETF outflows represent a tactical retreat, not a strategic withdrawal.

My Thoughts

This is a natural and healthy market breather. After a massive run-up, some profit-taking from ETF holders was inevitable. The key metric is the cumulative inflow, which remains powerfully positive. This pullback in ETF demand, coupled with a potential ETH price dip, may create an excellent accumulation zone for savvy investors. The institutional infrastructure is now built; short-term flows are just noise against that long-term signal.