Adoption Goes Vertical: Ethereum Network Growth Shatters Records

Forget the price charts for a second—the real story is happening under the hood. Ethereum is experiencing absolutely historic Ethereum network growth, shattering its own records with an average of 327,000 new wallets created every single day over the past week. This isn’t just a spike; it’s a sustained, fundamental surge in adoption, proving that user onboarding is exploding even while ETH price consolidates.

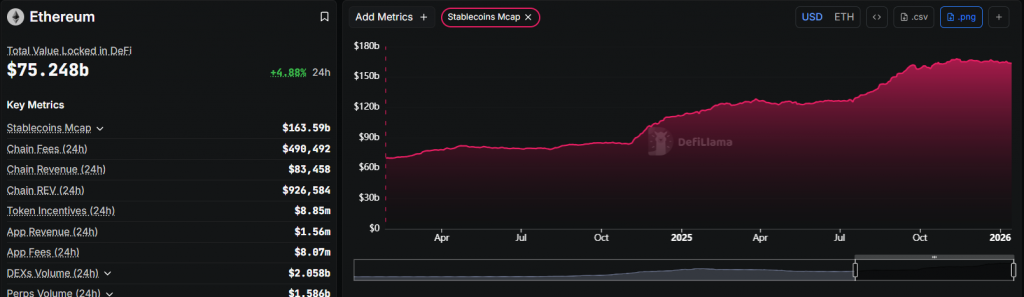

This growth climaxed on January 11 with a staggering 394,000 new wallets in a single day. What’s driving this unprecedented flood of new users? Two powerful forces: technology and utility. The Fusaka network upgrade, launched in December, drastically reduced data costs for Layer-2 networks, making transactions cheaper and smoother for everyday users. Meanwhile, Ethereum cemented its role as the world’s financial settlement layer, processing nearly $8 trillion in stablecoin transfers in Q4 2025 alone.

What This Historic Ethereum Network Growth Means

This record-breaking Ethereum network growth signals a critical shift. The network is maturing from a speculative trading platform into essential global financial infrastructure. The massive stablecoin volume indicates real-world value transfer, not just DeFi farming. Furthermore, this growth is organic and consistent—daily active addresses remain near peak levels, showing sustained engagement, not just one-off airdrop hunters.

While ETH price has been range-bound between $3,000 and $3,300, this decoupling of price from network usage is a classic bull market signal. It suggests accumulation and foundation-building beneath the surface. Large institutions like Bitmine are mirroring this long-term conviction, staking billions of dollars worth of ETH. When price finally catches up to this usage growth, the move could be explosive.

My Thoughts

This is the most bullish on-chain data you could ask for. Price follows usage, and Ethereum’s usage is going parabolic. The $8 trillion stablecoin figure is mind-blowing—it dwarves the narrative of “slow” or “expensive” transactions. This is institutional-scale settlement happening in real-time. For investors, this is a clear signal: the network effect is accelerating, and ETH is fundamentally undervalued relative to its utility. When the next bullish catalyst hits, the fuel tank is beyond full.