The global elite converged at Davos 2026, and crypto was squarely on the agenda. While central bankers issued stern warnings about monetary sovereignty, the real narrative was about adoption and the fierce regulatory race heating up. The message is clear: digital assets are now a core part of the global financial conversation.

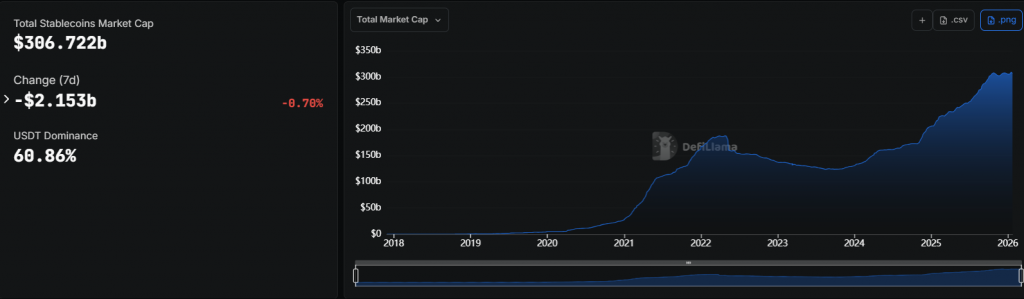

Stablecoins & Tokenization Take Center Stage

Let’s be real: the buzz wasn’t just about Bitcoin. This year, the focus shifted decisively to stablecoins & tokenization. Even critics, like the Governor of the Bank of France, François Villeroy de Galhau, admitted these innovations are “the name of the game.” He praised tokenization’s power to modernize finance, especially for wholesale markets. However, the mood shifted when Coinbase CEO Brian Armstrong championed Bitcoin as a check on government spending. The central banker fired back, declaring that money is inseparable from state sovereignty. This clash perfectly captures the philosophical battle now defining crypto’s future.

Trump’s Geopolitical Crypto Push

Meanwhile, the US political stance was starkly different. President Trump used his platform to frame crypto regulation as a critical geopolitical race. He emphasized urgent action to prevent China from gaining dominance. His goal? To sign pivotal market structure legislation and cement the US as the world’s crypto capital. This top-down support signals a potentially massive regulatory tailwind for the industry.

Binance’s Potential Comeback & Industry Defense

Adding to the intrigue, Binance co-CEO Richard Teng hinted at a possible return to the US market, calling it a “wait-and-see” approach. Furthermore, Circle CEO Jeremy Allaire powerfully dismissed fears that yield-bearing stablecoins could cause bank runs. He called such concerns “absolutely absurd,” arguing they act as customer retention tools, not systemic threats.

My Thoughts

Davos 2026 proved crypto is inescapable. The debate is no longer about if but how it integrates into the global system. The stark US vs. EU regulatory philosophies will create arbitrage opportunities and shape where innovation and capital flow. For investors, this political legitimization is a huge bullish signal, even amidst the noise.