Solana (SOL) is painting a confusing picture that seasoned traders live for. While the price has slumped to lows not seen since early January, the network itself is exploding with historic activity. This divergence between price and fundamentals is a classic setup that often precedes major moves. Let’s break down why this dip might be a gift.

On-Chain Metrics Are Screaming Bullish

Forget the price chart for a moment; the on-chain data is absolutely phenomenal. In the last 30 days, Solana processed a staggering over 2 billion transactions. To put that in perspective, that’s more than Ethereum and BSC combined. Active users soared 34% to 81.2 million, and network fees jumped 42% to $20 million. This isn’t just growth; it’s dominance.

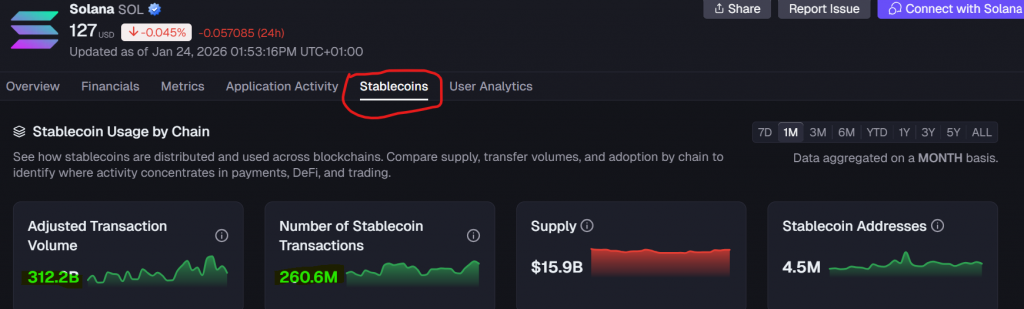

Furthermore, Solana’s DEX volume crushed competitors, handling over $107 billion—again, more than Ethereum, Base, and BSC together. Its stablecoin volume hit a monumental $312 billion across 260 million transactions. With stats like these, the current price action feels completely disconnected from reality.

A Crucial Solana Price Analysis: The Technical Setup

Now, let’s look at the charts. This is where it gets exciting. The recent pullback to $127 has actually formed two powerful bullish patterns on the daily timeframe. First, an inverted head-and-shoulders pattern is nearing completion. Second, a cup-and-handle formation is also in play. Currently, SOL is testing the neckline/handle area.

Technically, this sets up a potential rebound toward the year-to-date high of $148. A decisive break above that level could then open the path to the next major psychological target at $200. However, always manage risk: a sustained drop below the $118 support would invalidate this optimistic setup.

My Thoughts

This is a textbook “weak hands vs. strong fundamentals” moment. The market is likely shaken by broader macro sentiment, ignoring Solana’s blistering usage and technological dominance. For savvy investors, this disconnect creates a prime accumulation zone. The technical patterns align with the monstrous on-chain data, suggesting this dip is a buying opportunity, not a disaster.