A legendary Bitcoin bull run signal has just been triggered, sparking intense speculation that Bitcoin’s next major bull run is imminent. However, a deeper look at on-chain activity reveals a market still under significant sell-side pressure, suggesting any explosive move may need more time to develop.

Historic Bitcoin Bull Run Signal Reappears

Analyst Coinvo Trading has spotted a rare and powerful signal: a bullish cross between the Stochastic RSI of the US and China 10-Year Bond Yields against Bitcoin’s weekly chart. This signal has only occurred four times in history, each preceding massive rallies. The last instance was in October 2020, which kicked off the 600% surge to then-all-time highs.

Furthermore, analyst Matthew Hyland points to the DXY (US Dollar Index) nearing a breakdown below 96—a level that previously catalyzed major BTC rallies in 2017 and 2020. The growing divergence between record-high gold and range-bound Bitcoin is also seen by firms like Swan not as a warning, but as a typical prelude to a “violent” crypto breakout.

On-Chain Reality Check: A Fragile Market

Despite these bullish technical setups, on-chain metrics paint a more cautious picture. The spot Cumulative Volume Delta (CVD), which measures net buying vs. selling pressure, has flipped sharply negative to -$194 million. This indicates traders have meaningfully shifted to a risk-off stance.

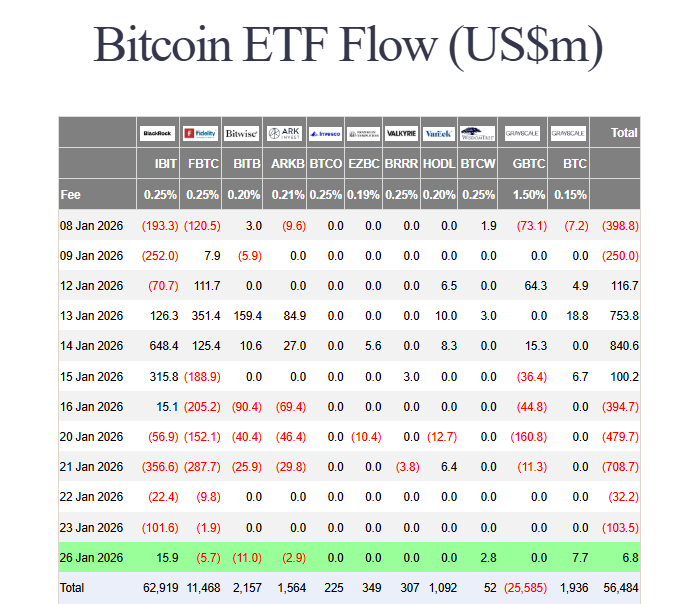

Critically, spot Bitcoin ETF flows have reversed from massive inflows to a $1.7 billion weekly outflow, cooling institutional demand. Glassnode notes the market remains “fragile,” with persistent sell-side pressure and rising hedging activity limiting upside potential in the near term.

My Thoughts

This is the classic conflict between leading indicators and coincident data. The bull signal is compelling and historically reliable, but it’s a macro timing tool, not a micro trade trigger. The on-chain fragility likely needs to resolve through further consolidation or a final shakeout. My take? The signal is too significant to ignore. It likely means we are in the final stages of accumulation before the next parabolic phase. However, navigating the current volatility requires strict risk management.