Institutional confidence is cracking. On Thursday, U.S.-listed spot Bitcoin and Ethereum ETFs experienced a devastating single-day exodus, with nearly $1 billion yanked from these funds. This marks one of the worst combined crypto ETF outflows days in 2026, signaling that major players are hitting the sell button amid tumbling prices and spiking volatility.

Breaking Down the Massive Crypto ETF Outflows

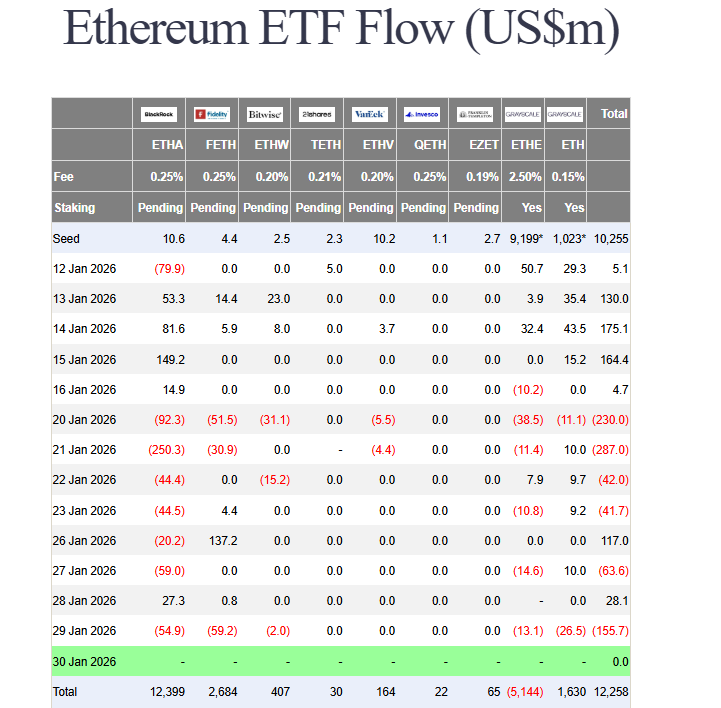

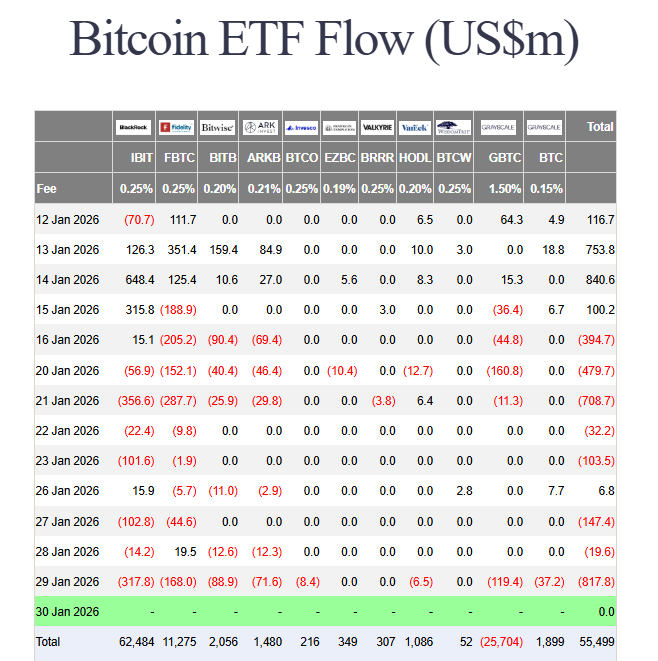

Bitcoin ETFs bled $817.9 million, their largest outflow since late November 2025. Ethereum ETFs lost another $155.6 million. Even XRP funds saw significant redemptions at $92.9 million. The selling was broad-based, led by giants BlackRock and Fidelity, indicating a sector-wide risk-off move, not a simple rotation between assets.

This institutional flight coincided with a sharp market plunge. Bitcoin briefly crashed through $81,000 before a partial recovery. The scale of these outflows suggests professional money is cutting exposure, adding substantial selling pressure on top of retail fear.

Arthur Hayes Points to a Liquidity Crisis

BitMEX co-founder Arthur Hayes offers a macro explanation. He ties Bitcoin’s decline to a rapid drain in U.S. dollar liquidity, specifically a $200 billion surge in the U.S. Treasury General Account (TGA). This effectively pulls cash out of the financial system, tightening conditions. Hayes speculates the Treasury is hoarding cash ahead of a potential government shutdown, a move that directly starves risk assets of needed liquidity.

My Thoughts

This is a watershed moment. When the largest, most compliant on-ramps for institutional capital see exits of this magnitude, it confirms a profound shift in sentiment. This isn’t profit-taking; it’s risk management at scale. The Hayes liquidity thesis is critical—it shows the crypto market is reacting to hidden plumbing issues in traditional finance. While terrifying, such violent flushing of weak institutional hands often creates the cleansing needed for a stronger foundation. The path forward depends on stability returning to the ETF flow data.