The sell-off has turned into a full-blown cascade. Bitcoin Price Crash below the critical $80,000 support level, plummeting to a new yearly low near $78,000. This sharp decline marks Bitcoin’s lowest price since April 2025 and has triggered a massive liquidation event across the crypto market, signaling a severe shift in sentiment.

Breaking Down the Bitcoin Price Crash

This isn’t a routine dip. Bitcoin is down over 6% on the day, erasing gains and breaking key psychological support. The move has been fueled by a perfect storm of pressures:

- Relentless ETF Outflows: Spot Bitcoin ETFs recorded a devastating $818 million in single-day outflows on January 29th, and $528 million on January 30th as part of a $1.61 billion monthly exodus. This is the first three-month outflow streak since their launch.

- Miner Selling: On-chain data reveals miners are capitulating, sending coins to exchanges and adding to the sell-side pressure.

- Hawkish Macro Pivot: The nomination of inflation hawk Kevin Warsh as Fed Chair, coupled with a hotter-than-expected PPI inflation print, has markets fearing a “higher-for-longer” interest rate environment.

Market Carnage and Liquidations

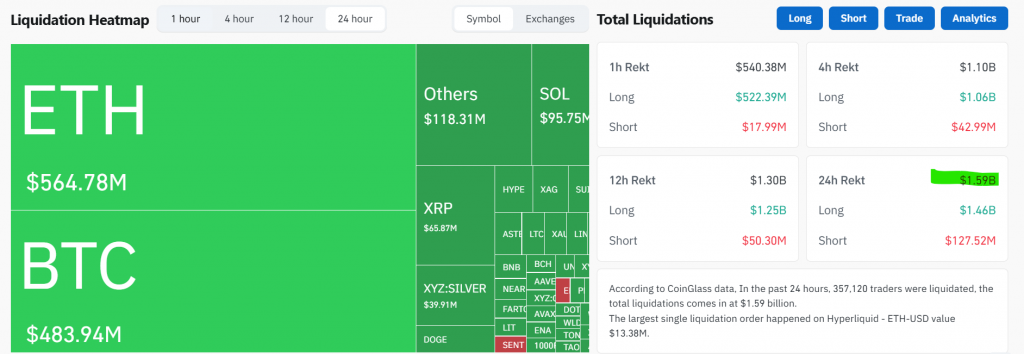

The fallout is widespread. The crypto market has seen $1.49 billion in liquidations in 24 hours, with $1.46 billion from long positions alone. Altcoins have been decimated, with Ethereum down over 11%. Analysts like Peter Brandt now warn of a potential drop toward $66,000 if the breakdown continues.

A critical level to watch is $76,037—the average purchase price of Strategy’s massive 712,647 BTC treasury. A sustained break below this could signal a deeper, more fundamental valuation reset.

My Thoughts

This is capitulation. The break below $80K confirms we are in a new, more volatile phase of the cycle. While painful, such washes are necessary to reset leverage and sentiment. The focus now shifts to the $76K MSTR cost basis—a bounce there would suggest institutional conviction remains, while a break could trigger another leg down. This is not the time for panic, but for disciplined planning. Accumulation strategies should be staged, and risk management is paramount.