The institutional exodus is gaining momentum, sparking a fierce philosophical debate at the worst possible time. Spot Bitcoin ETF outflows surged to $690 million net this week, accelerating as BTC price briefly cratered to $60,000 for the first time since October 2024. This relentless selling pressure is now igniting a critical market conversation: are these very ETFs, designed to bolster adoption, actually undermining Bitcoin’s core value proposition?

Breaking Down the Heavy Bitcoin ETF Outflows

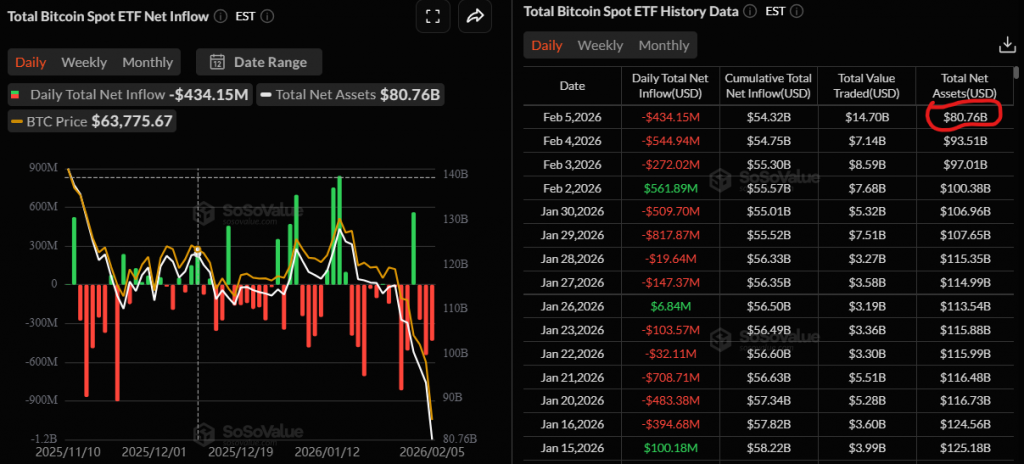

The data reveals a troubling trend. Outflows hit $434 million on Thursday, following a $545 million redemption the day before. This wiped out Monday’s $561 million inflow, confirming that institutional sentiment remains deeply risk-off. Total ETF assets have shrunk to approximately $81 billion, reflecting the intense market-wide deleveraging.

As prices plunge, the community is grappling with the cause. Some analysts now point a finger at the ETFs themselves, arguing that the “institutionalization” of Bitcoin has created a dangerous layer of financial abstraction.

The “Paper Bitcoin” Scarcity Debate Ignites

Critics contend that ETFs have introduced a fractional reserve system for Bitcoin. As analyst Bob Kendall argues, a single BTC can now back multiple derivative layers simultaneously—an ETF share, futures contract, perpetual swap, and more. This, they claim, dilutes Bitcoin’s legendary scarcity, a cornerstone of its value.

This echoes pre-launch warnings that ETFs could enable the creation of “millions of unbacked Bitcoin,” potentially depressing the value of the real asset. The debate cuts to the heart of Bitcoin’s ethos: is it better as a pristine, scarce asset held directly, or as a widely accessible—but potentially diluted—financial instrument?

My Thoughts

This is a necessary, if painful, maturation. The Bitcoin ETF outflows show that institutional capital is fair-weather, not diamond-handed. However, the “paper Bitcoin” debate is somewhat misplaced; the leverage and rehypothecation exist primarily in derivatives, not in the spot ETF structure itself. The real issue is liquidity and sentiment. This flush is purging weak institutional hands. Once this distribution cycle ends, the remaining ETF holdings will represent stronger, more committed capital. For now, $60,000 is the line in the sand. Hold above it, and a base forms. Break below, and the path opens to lower targets.