The tide has turned. After a brutal three-day exodus that saw $1.25 billion flee spot Bitcoin ETFs, institutional demand roared back with a decisive $330.67 million net Bitcoin ETF inflows. This powerful reversal, led by the industry’s largest issuer, signals that professional buyers are stepping back in, potentially marking a local bottom for the battered market.

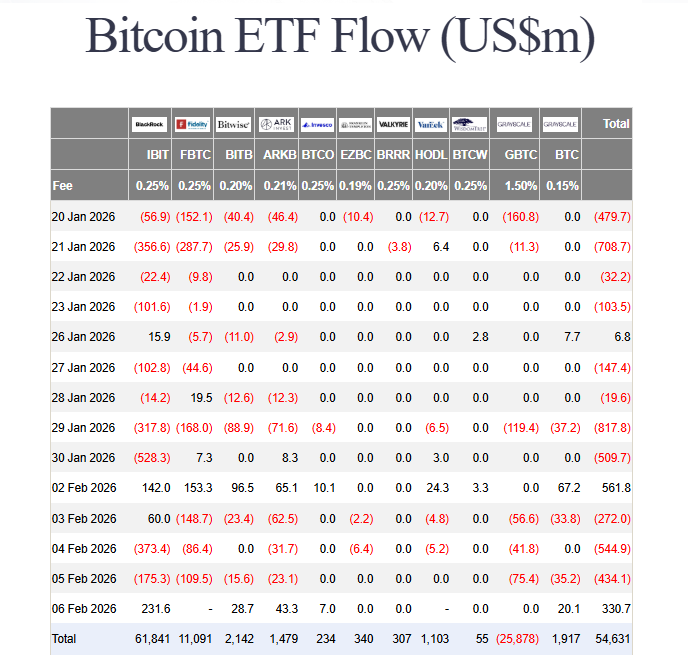

Breaking Down the Critical Bitcoin ETF Inflows

BlackRock’s IBIT fund commanded the comeback, attracting $231.62 million of the total influx. Ark 21Shares’ ARKB and Bitwise’s BITB contributed a combined ~$72 million, demonstrating broad-based buying interest beyond just the giant. This influx helped lift total ETF assets under management from a low of $80.76 billion back to approximately $105 billion.

The timing is crucial. This buying pressure emerged as Bitcoin’s price staged a 6.6% rebound, stabilizing near the $67,000 level. It suggests institutions viewed the dip below $65,000 as a valuation opportunity, not a reason to abandon ship.

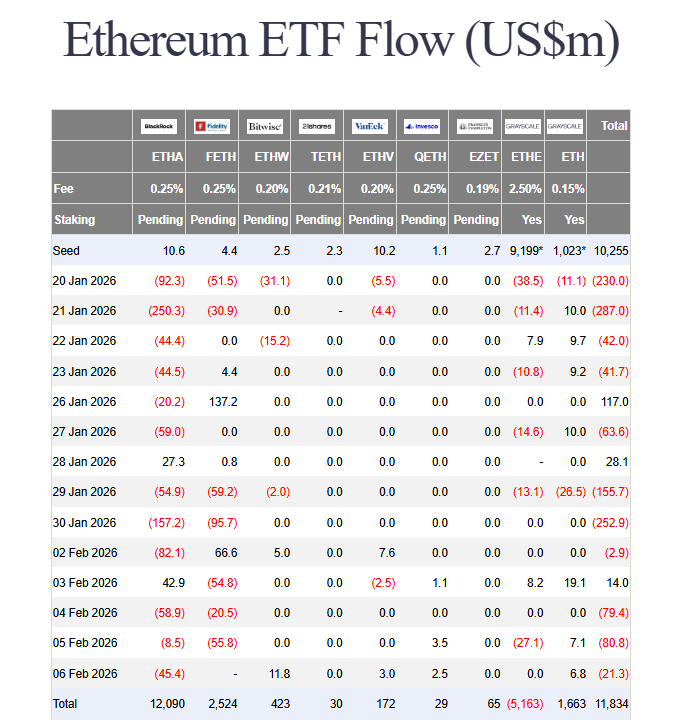

A Stark Divergence: Bitcoin In, Ethereum Out

The recovery was not universal. While Bitcoin ETFs saw inflows, Ethereum spot ETFs continued to bleed, posting $21.37 million in net outflows. BlackRock’s ETHA product was the primary source of redemptions. This divergence highlights where institutional confidence is returning first and underscores Bitcoin’s continued role as the primary benchmark asset.

My Thoughts

This is the institutional vote of confidence we needed. The return of Bitcoin ETF inflows after such a violent purge indicates that the first wave of panic selling is likely over. It doesn’t guarantee a V-shaped recovery, but it strongly suggests a floor is forming. The fact that BlackRock led the charge is especially significant; it shows the smartest institutional money is beginning to re-accumulate. Watch this trend closely—if inflows sustain for several sessions, it will confirm a decisive shift in momentum and likely propel a stronger relief rally toward $70,000 and beyond.