Coinbase Global Inc. finds itself at the epicenter of the latest significant milestone in the world of cryptocurrency with the launch of US spot-Bitcoin ETFs. However, what might appear as an advantageous position also introduces a slew of challenges and risks for Coinbase and its partners.

The commencement of trading for the first exchange-traded funds directly investing in Bitcoin comes after the US Securities and Exchange Commission approved applications from nearly a dozen investment firms, including industry giants like BlackRock Inc. and Franklin Templeton. This development, following years of industry efforts, is seen as a crucial step that will fuel broader adoption of the world’s largest cryptocurrency.

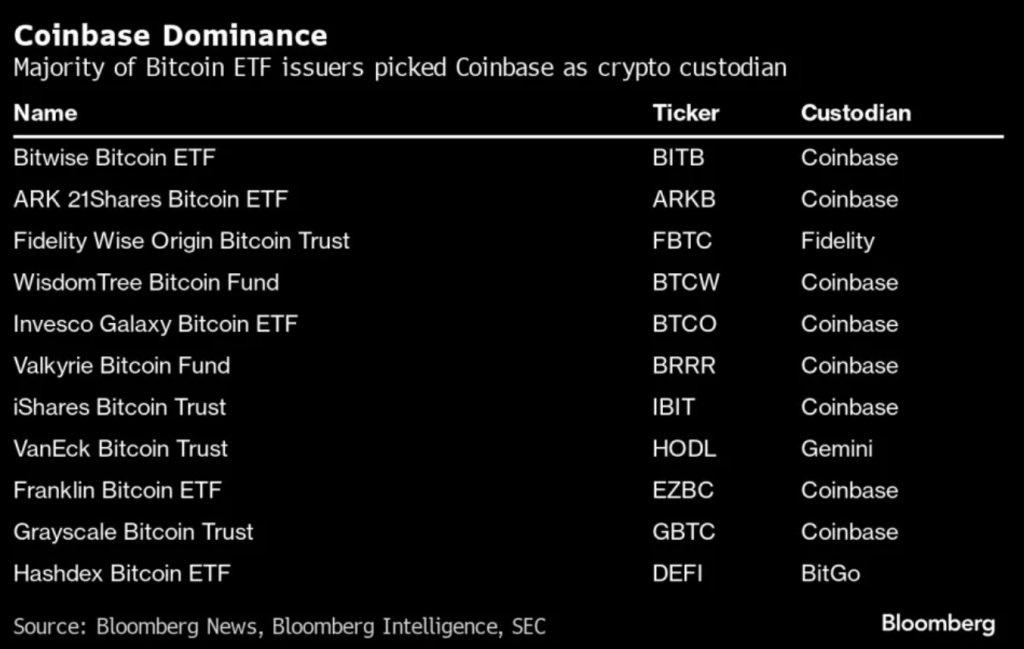

The majority of ETF issuers will rely on Coinbase for various functions, with the digital-asset exchange set to provide custodial, trading, and lending services to heavyweights such as BlackRock. While Coinbase stands to benefit from Bitcoin’s entry into traditional markets, concerns arise about the potential concentration of risk and the emergence of low-fee Bitcoin investment options that could impact Coinbase’s core trading platform revenue.

The SEC, embroiled in a legal battle with Coinbase, shares concerns about the company’s multiple roles. The agency accused Coinbase of running an unregistered exchange, broker-dealer, and clearinghouse for tokens considered securities. Despite these challenges, Coinbase remains the preferred custody provider for Bitcoin ETFs.

However, critics point out the concentration risk and suggest a multi-custodian setup to mitigate unforeseen problems. Alesia Haas, Coinbase’s CFO, asserts the company’s diligence in avoiding conflicts of interest, emphasizing that the custody business is not at issue in the SEC case.

Coinbase’s pivotal role as the sole trading agent for BlackRock, coupled with its lending business, adds complexity to the Bitcoin ETF ecosystem. While the new ETFs may contribute modestly to Coinbase’s revenue, concerns about potential fee compression loom, especially as customers may opt for lower-fee ETFs over Coinbase’s trading platform.

Despite the challenges, Coinbase’s shares soared last year, and the company sees the arrival of Bitcoin ETFs as a positive addition to the crypto market. The future may see ETFs diversifying their custodians to reduce reliance on a single entity, although Coinbase anticipates retaining a significant share of assets.

As a public company, Coinbase’s heightened scrutiny may serve as an advantage, attracting more business in the long term. While acknowledging potential challenges, Coinbase is currently basking in the excitement of its victory as Bitcoin ETFs make their debut, symbolizing a momentous occasion for the company and the crypto industry at large.