Ki Young Ju, the visionary behind CryptoQuant, a prominent on-chain analytics firm, recently revised his perspective on Ethereum’s (ETH) staking progress and offered insights on the aftermath of the Shapella hard fork. In a candid admission, he acknowledged being mistaken about the effects of the Shapella upgrade.

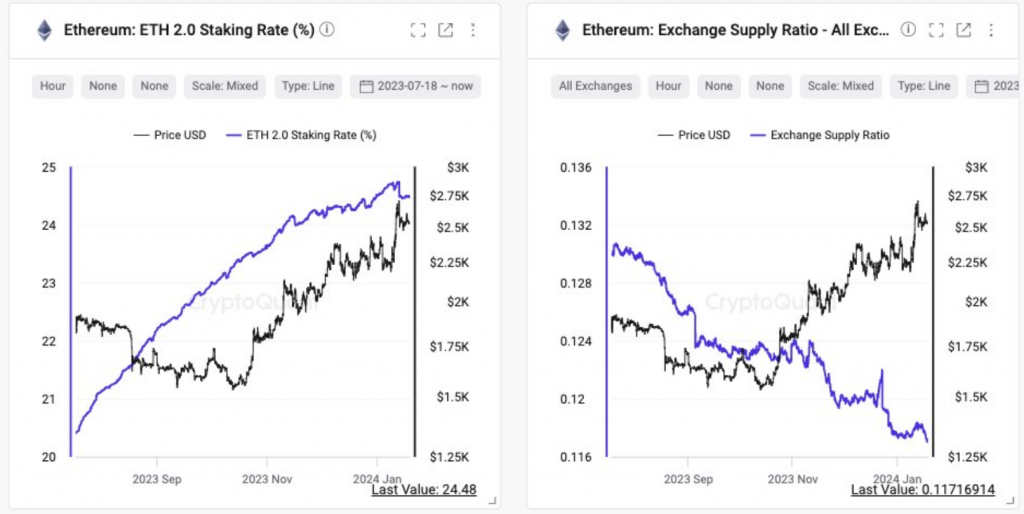

The Ethereum (ETH) staking ratio has skyrocketed to an impressive 24%, and the momentum continues. Notably, only 11% of the total ETH supply resides on centralized exchanges. Ki Young Ju disclosed this data on January 18, 2024, affirming that the much-anticipated Shapella upgrade, enabling stakers to withdraw their coins for the first time since December 2020, did not lead to the expected massive unstaking.

Shapella, activated in April 2023 during a period of prevailing bearish sentiment in the crypto markets, sparked predictions of withdrawals and subsequent sell-offs of Ethereum (ETH). Despite stakers withdrawing 1 million Ethers (ETH) in the first week post-Shapella, the ETH price fluctuated between $2,000 and $2,100, avoiding significant losses.

According to Ki Young Ju, staked Ethereums (ETH) are proving to be profitable, with a realized price for staking inflows at $2,014, while the current ETH rate stands at $2,519. This translates to an average Ether “stake” being held with a substantial 25% profit. The cumulative volume of the Ethereum (ETH) staking ecosystem is an impressive $72 billion, offering a 4.25% Annual Percentage Yield (APY), according to Staking Rewards data.

In an interesting development, Ethereum’s (ETH) primary rivals seem on the verge of a historic “flippening.” Solana (SOL) witnesses a significant decline in staking ratio, losing over 20% in the last week and dropping below 67%. Meanwhile, Cardano (ADA) is gaining ground, adding 0.06% in the last seven days and inching closer to a 64% staking ratio. Although Solana (SOL) maintains a USD-denominated staking volume over 200% larger than Cardano (ADA), the latter is nearing a potential milestone.

Among mainstream altcoins, Mina Protocol (MINA) boasts the highest staking ratio, with stakers locking over 91% of the circulating supply. Aptos (APT) and Sui (SUI) closely follow the Mina Protocol (MINA) with staking ratios of 85%-86%. The landscape of cryptocurrency staking continues to evolve, presenting opportunities and challenges for investors in various projects.