The Grayscale Bitcoin fund has witnessed substantial outflows since its conversion to a spot Bitcoin ETF, with a significant portion attributed to the FTX bankruptcy estate. FTX reportedly liquidated 22 million shares from the Bitcoin fund, amounting to approximately $900 million.

FTX’s Role in Outflows

FTX, undergoing bankruptcy proceedings, divested its entire holdings in the Grayscale Bitcoin fund, resulting in the sale of 22 million shares valued at $900 million. This sizeable sum contributes to a broader trend of outflows totaling around $2 billion in shares since the fund’s transition to an exchange-traded fund. The Grayscale Bitcoin Trust (GBTC) had functioned as a closed-end fund before its conversion into an ETF, making it distinct in structure.

Spot Bitcoin ETFs, including Grayscale’s, commenced trading on January 11, following the Securities and Exchange Commission’s approval. Despite the anticipation of positive market reactions to the approval, Grayscale’s fund, existing for over a decade, experienced substantial outflows, particularly influenced by FTX’s sell-off.

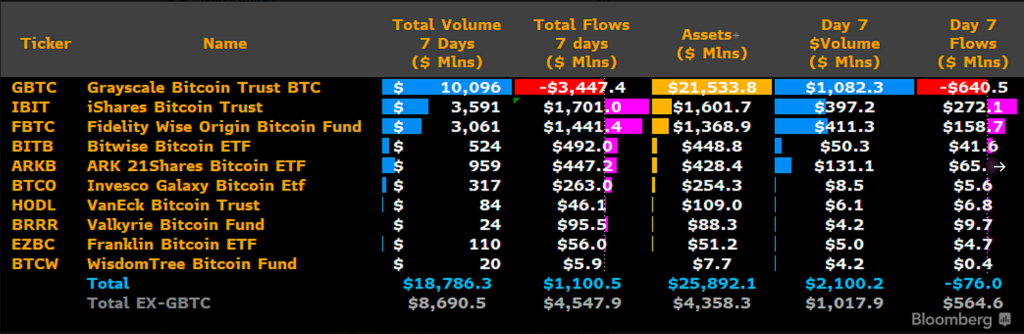

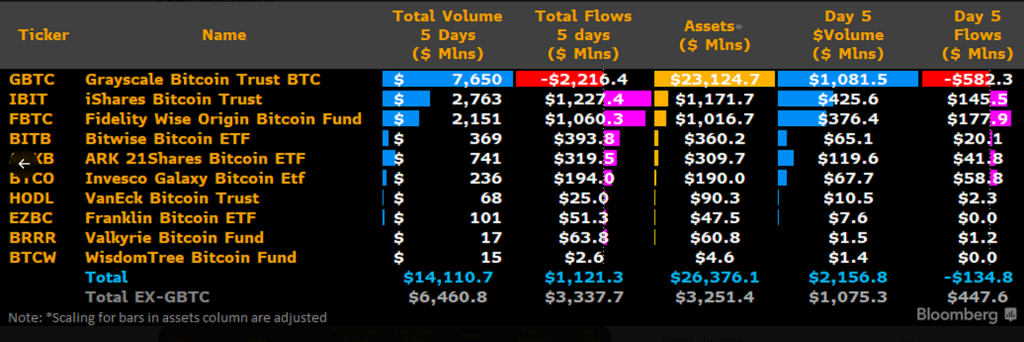

Bitcoin ETF Landscape

While BlackRock and Fidelity’s funds saw significant inflows, Grayscale’s GBTC encountered considerable fund withdrawals, with FTX being a major contributor. In the initial three days of spot Bitcoin ETF trading, net inflows touched nearly $1 billion, primarily led by BlackRock.

Bitcoin Price Movement

Contrary to optimistic expectations, the price of Bitcoin witnessed a decline following the SEC’s approval of spot Bitcoin ETFs. The hope was that ETF approval would positively impact Bitcoin prices, providing an easier route for regular investors to enter the market. However, Bitcoin responded differently, experiencing a drop.

FTX’s Exit Strategy

With FTX completing the sale of its substantial GBTC holdings, it is anticipated that selling pressure on the Grayscale Bitcoin fund could alleviate. FTX strategically capitalized on the price disparity between Grayscale trust shares and the net asset value of the underlying Bitcoin in the fund. As of October 25, 2023, FTX held 22.3 million GBTC valued at $597 million, according to a November 2023 filing. The value of FTX’s GBTC holdings surged to $900 million on the first day of Grayscale’s Bitcoin ETF trading on NYSE Arca, closing the session at around $40.

Additionally, FTX held shares in five Grayscale Trusts and nearly 3 million shares in a statutory trust managed by ETF provider Bitwise in a brokerage account at ED&F Man Capital Markets, now known as Marex Capital Markets.