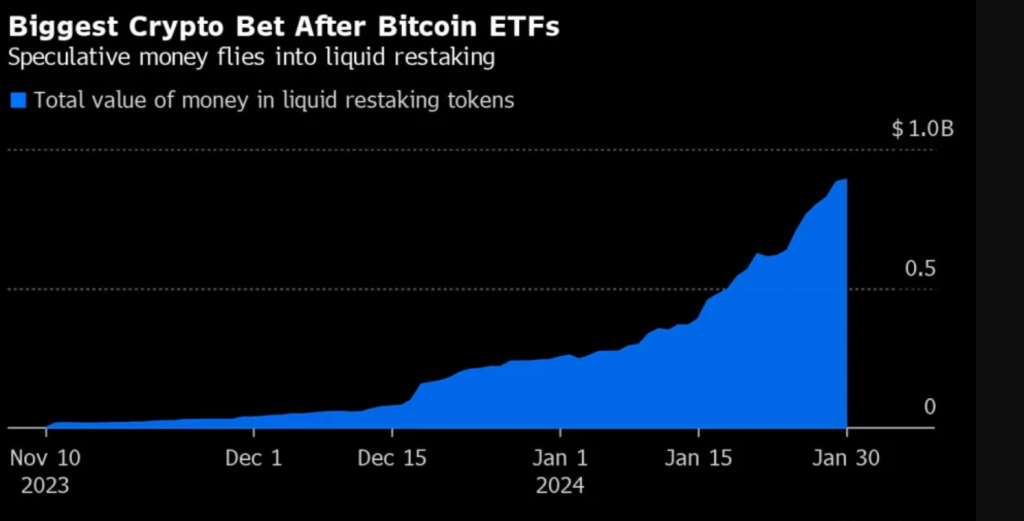

Decentralized finance (DeFi) is reaffirming its reputation as the unruly frontier of the crypto world. Investors have funneled nearly $2 billion worth of Ether and its derivatives into an experimental protocol designed to simplify the setup of blockchain projects, all in the hopes of scoring significant returns once these projects go live.

Additionally, substantial amounts of cryptocurrencies, totaling hundreds of millions of dollars, have been deposited on DeFi platforms like Pendle Finance, offering returns exceeding 30%, with expectations of even higher incentive payouts.

DeFi has been a crypto trailblazer since its inception, aiming to create a financial marketplace without reliance on traditional banks or intermediaries. After a surge in popularity in 2018 and subsequent struggles in 2022, the DeFi sector is now attempting to recover amid challenges such as hacks and questionable projects.

“As people chase higher yields, it will encourage the rehypothecation of ETH to riskier networks in the chase of those higher yields,” commented Anil Lulla, co-founder of crypto research firm Delphi Digital.

Ether, the second-largest cryptocurrency, is flowing into the EigenLayer platform for what’s termed “restaking.” This process, inspired by Ethereum’s proof-of-stake network transformation in 2022, involves depositing or “staking” tokens to help validate transactions. Restaking aims to support new networks lacking staking activity by compensating holders, expediting project development.

However, caution prevails in EigenLayer’s progress, with the startup taking substantial precautions to address potential risks. The Ethereum community, including co-founder Vitalik Buterin, has warned about leveraging Ethereum’s security, particularly the risk of slashing where stakers may lose some tokens due to rule violations.

Despite concerns, new platforms have surfaced, contributing significantly to EigenLayer’s growth by providing derivative versions of restaked Ether tokens. These liquid staking tokens are utilized in various DeFi applications, from earning rewards in money market protocols to borrowing against the derivatives for increased staking rewards.

DeFi enthusiasts are also turning to platforms like Pendle Finance to make leveraged bets on potential restaking rewards, offering over 30% returns on deposited liquid restaking Ether tokens. Yet, analysts express worries that the influx of money into this speculative sector, centered on a project yet to go live, may be reminiscent of the risky pursuit of high returns before they materialize. EigenLayer’s official launch is scheduled for the first half of this year, signaling a pivotal moment for the evolving DeFi landscape.

“Restaking is super interesting as a technology, but unproven in terms of safety,” remarked Leo Mizuhara, founder and CEO of DeFi institutional asset manager Hashnote. “Each restaking protocol is going to require extensive research, which makes investment difficult and time-consuming.”