Bitcoin surged to $60,000, marking its highest value in over two years, driven by growing optimism that interest in the cryptocurrency is broadening beyond its core enthusiast base.

The cryptocurrency’s value has already soared more than 40% since the beginning of the year, propelled partly by the successful introduction of US exchange-traded funds (ETFs) holding Bitcoin. These ETFs have attracted over $6 billion in investments since their launch on January 11. Bitcoin last reached $60,000 in November 2021, following its peak near $69,000 earlier that same month.

“It’s quite astonishing,” remarked Ryan Kim, head of derivatives at digital-asset prime brokerage FalconX.

An upcoming reduction in Bitcoin’s supply growth, known as the halving, is contributing to the positive sentiment. This factor, coupled with an ongoing rally that has ignited speculative interest in various other tokens like Ether and Dogecoin, is fueling what some describe as a “fear of missing out” (FOMO) rally.

“We’re witnessing a clear FOMO-driven rally,” observed Zaheer Ebtikar, founder of crypto fund Split Capital. “More and more people are becoming convinced to invest.”

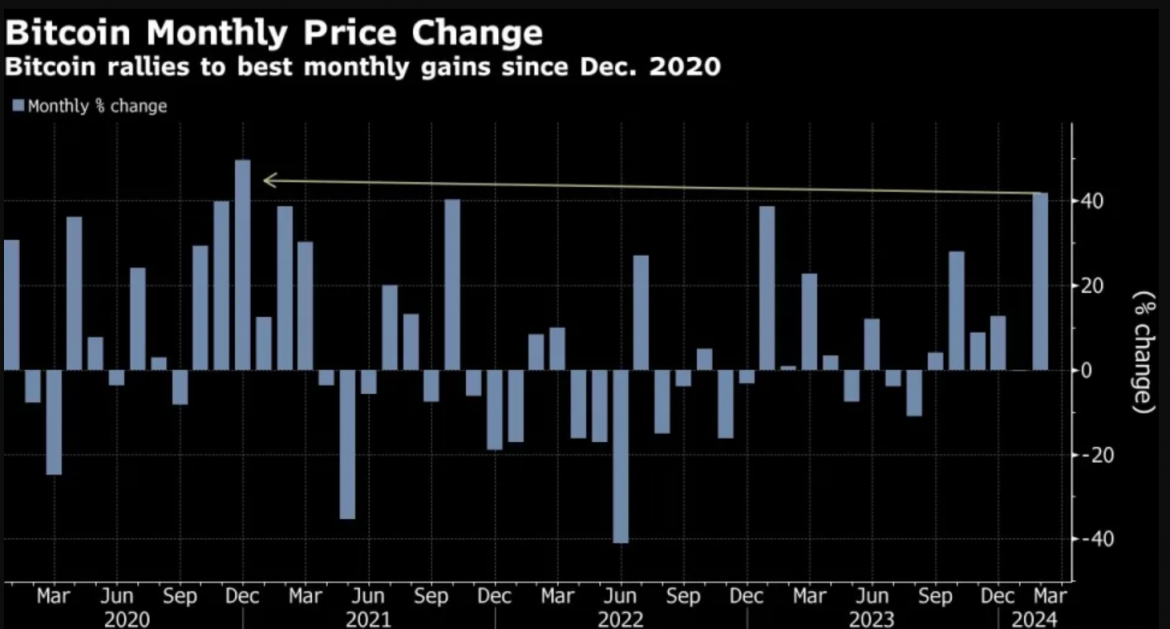

Bitcoin is on track for its most significant monthly gain since December 2020, when it surged 50% to around $9,600. Its value has more than tripled since the beginning of last year, rebounding from a steep 64% decline in 2022. This remarkable resurgence follows a period of skepticism fueled by scandals and bankruptcies within the crypto industry.

Despite expectations for tighter monetary policy, reflected in rising US Treasury yields, digital tokens like Bitcoin continue to rally. Bitcoin has outperformed traditional assets such as stocks and gold in 2024.

“This turnaround is particularly noteworthy given central banks’ indications of keeping rates elevated for some time, challenging the assumption that the next crypto bull run would be driven by falling interest rates,” noted Michael Safai, co-founder at quantitative trading firm Dexterity Capital.

The significant inflows into Bitcoin ETFs have raised concerns about a potential supply squeeze, as new coins from miners struggle to keep pace with demand. Approximately 80% of Bitcoin’s supply hasn’t changed hands in the past six months, intensifying the squeeze and adding upward pressure on prices, analysts suggest.

The nine new spot ETFs collectively hold more than 300,000 Bitcoin, seven times the amount of new coins mined since January 11. Following the halving, expected in late April, the daily output of new coins will decrease from 900 to 450. If demand remains steady while the supply of new coins halves, proponents anticipate further price increases.

“All these factors together create a supply and demand imbalance,” explained Dan Slavin, founder of Chainview Capital, a crypto hedge fund. “More demand than supply means higher prices, and in the volatile world of BTC, higher prices mean much more than just a 10% increase.”