Recent data suggests a growing interest in Solana, with an uptick in on-chain activity indicating a strong demand for SOL tokens.

An independent market analyst, Hansolar, suggests that Solana might be on the brink of a significant surge in the current cryptocurrency market boom, which is primarily being driven by Bitcoin. According to Hansolar, SOL’s price could potentially soar to $600.

Hansolar’s bullish outlook for Solana is based on its potential to mirror the price trends seen with Ethereum (ETH) during previous bull runs in the crypto market. For instance, during the bullish cycle of 2020-2021, ETH’s price skyrocketed from around $85 to a staggering $4,935, following Bitcoin’s upward trajectory.

Interestingly, ETH’s price surged by approximately 1,400% after Bitcoin hit a new all-time high above $20,000. This pattern, as illustrated in historical data, might repeat in 2024, especially if Bitcoin continues its extended bull run, surpassing its previous record high of $69,000 from November 2021. Hansolar argues that as Bitcoin reaches new heights, it could also benefit Solana, as it did before.

Hansolar notes that historically, Ethereum gained momentum when Bitcoin broke out to all-time highs, leading to increased retail interest in Solana as a high-beta catch-up play. Currently, SOL is trading around 50% below its all-time highs, similar to ETH’s position when Bitcoin was nearing its previous all-time highs in the last cycle.

Looking ahead, if Bitcoin reaches the projected valuation of $150,000, as predicted by Tom Lee, Head of Research at Fundstrat, on the prospects of ETF approval, Solana could aim for $600 as its long-term target, representing a nearly 450% increase from its current price.

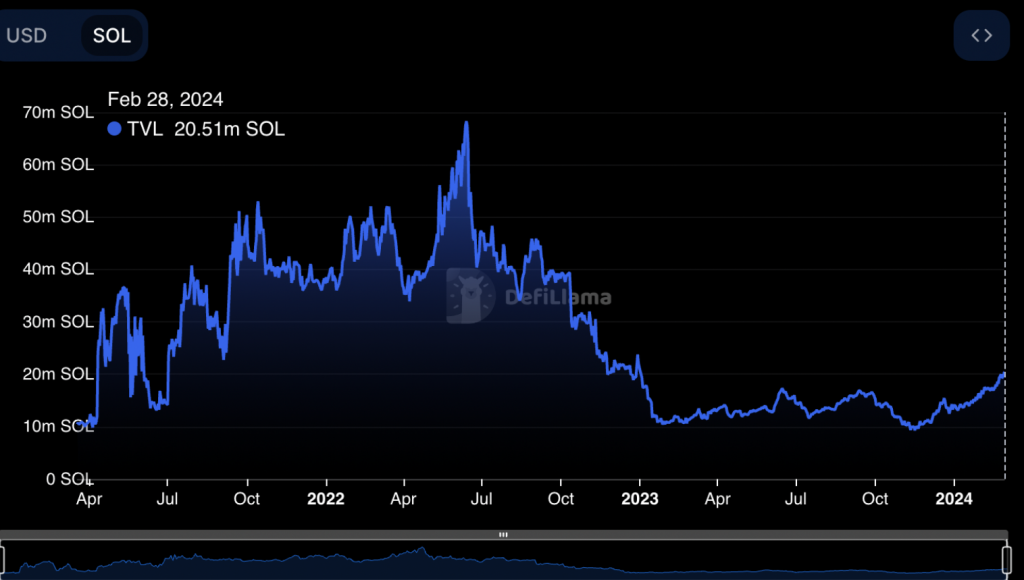

In terms of fundamentals, Solana has shown promising network adoption, with the total value locked (TVL) across its ecosystem reaching 20.51 million SOL, its highest level since January 2023. This increase in locked assets within DeFi platforms could lead to a scarcity effect, potentially driving up demand for SOL tokens and subsequently their price.

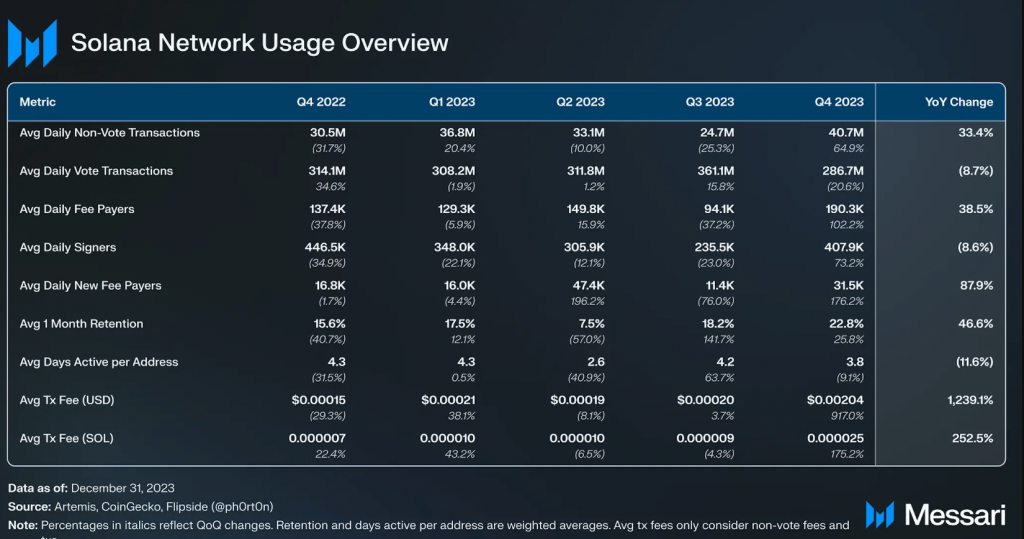

Solana’s rising TVL aligns with its sustained growth quarter-over-quarter (QoQ) as tracked by Messari. During Q4/2023, the network witnessed a significant surge in average daily fee payers and decentralized exchange (DEX) volume, as well as NFT volume. Additionally, the recent airdrop of Jupiter DEX’s native token, JUP, further boosted on-chain activity on the Solana blockchain, highlighting a strong underlying demand for SOL tokens.

From a technical standpoint, Solana is eyeing $200 as its primary upside target in the near term, supported by the formation of a bullish continuation pattern known as a bull pennant on its daily chart. This pattern typically emerges after a strong upward movement in price and suggests further upward momentum if the price breaks above the upper trendline. Conversely, a breakdown below the lower trendline could invalidate the bullish setup, potentially leading to a price decline towards $60.75.