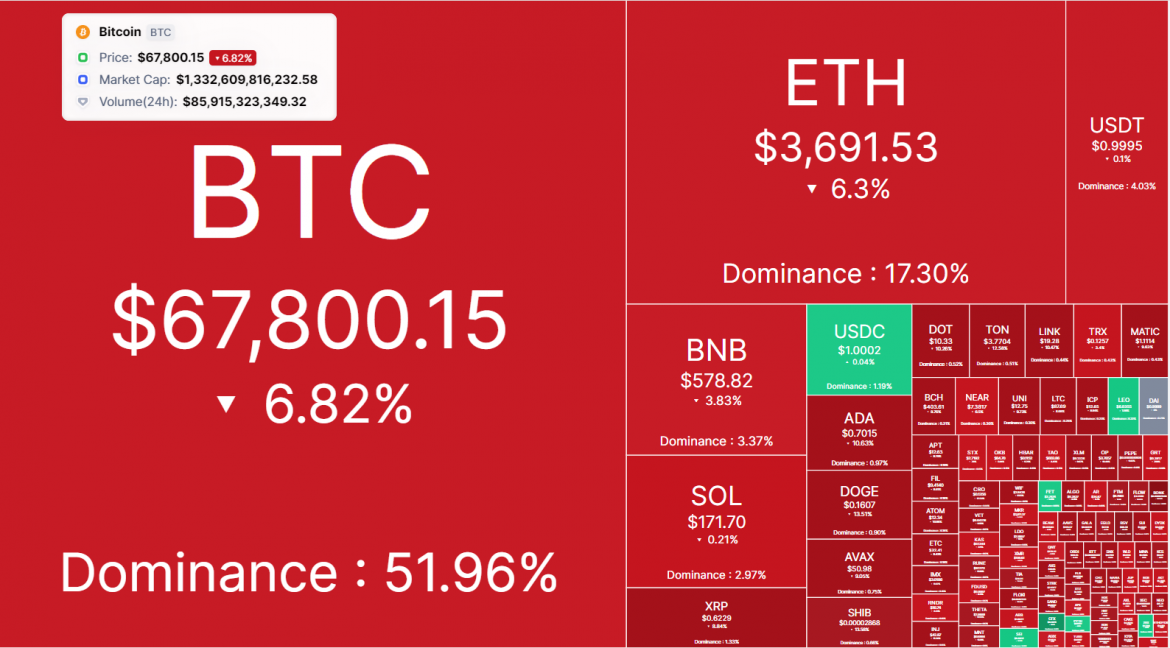

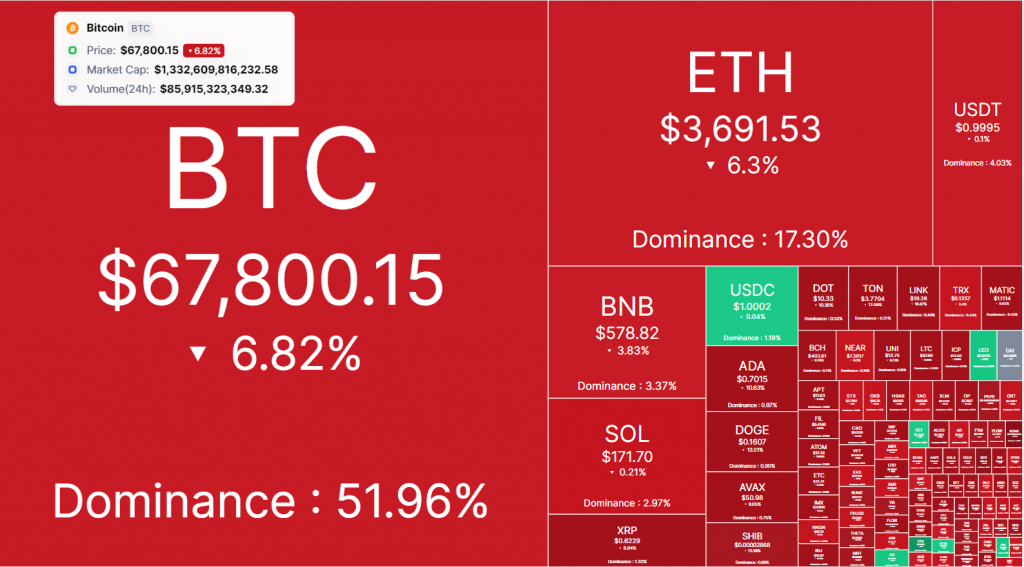

Solana (SOL) stands out among the top 10 altcoins today, being the only one to show a price increase in the last 24 hours. Meanwhile, its counterparts like Ethereum and XRP have experienced notable losses, and even Bitcoin saw a decline of 7% in its value during the same period.

In the past day, SOL has risen by 2.94%, reaching $174.38, maintaining its bullish momentum that has seen a remarkable 55% surge over the past month.

What’s driving SOL’s recent impressive performance? Over the last week alone, Solana’s price has skyrocketed by 21%, marking a staggering 724.6% increase compared to a year ago. This surge is closely linked to the developments within its ecosystem. SOL’s breach of the $170 mark hints at a potential retest of its all-time high around $260.

The resurgence of this altcoin started gaining traction in late 2023, fueled by heightened developer interest and retention. Recent advancements such as the introduction of a stablecoin backed by the Israeli Shekel (BILS) and the bolstering of liquidity through USDC stablecoin support have attracted more users to the Solana blockchain. These innovations are positioning the blockchain for the anticipated surge in tokenization of real-world assets, with Solana’s rapid transaction times poised to facilitate the exchange of certificates representing ownership of tangible assets.

As a result, Solana has seen a significant uptick in its weekly user base, jumping from 432,000 to nearly 800,000 within just over a week from February 26 to March 7, 2024—an 85% increase. This indicates a positive sentiment shared by both investors and traders, despite the network’s track record of occasional outages and service disruptions that have occurred almost every year since its inception. The most recent outage, on February 6, halted block progression for approximately five hours.

Despite its impressive growth, Solana faces challenges ahead. A recent glitch on the crypto exchange Coinbase, which affected users’ ability to view accurate balances, underscores the inevitable hiccups accompanying heightened blockchain activity. Binance’s temporary suspension of Solana withdrawals aimed to enhance its infrastructure amidst increased volumes on the Solana network. Yet, critics like Bitcoin maximalist Max Keiser have pointed out concerns regarding Solana’s infrastructure centralization, particularly its relatively small pool of validators.

Keiser went as far as to label SOL as “centralized garbage.”

Furthermore, Ethereum poses a potential threat following its successful Dencun upgrade, which significantly reduced transaction fees. Gas costs on major Ethereum layer-two networks like Zora and Base are now approaching Solana’s levels merely two days into the upgrade. According to Solscan, the average transaction cost on Solana stands at $0.0017, while it’s $0.002 on Zora and $0.055 on Base.