Bitcoin is at a pivotal inflection point. After sliding from its $126,300 all-time high, BTC faces a make-or-break week packed with macro catalysts and political momentum. All eyes are on three major events: a critical White House crypto summit, U.S. non-farm payrolls (NFP) data, and the latest Consumer Price Index (CPI) inflation report. The outcome of this trifecta could determine Bitcoin price prediction for the coming quarter.

Macro Catalysts: Politics and Economics Collide

On Tuesday, a major White House summit will convene top officials from banks like JPMorgan and crypto leaders from firms like Coinbase and Ripple. The goal: to break the deadlock on the CLARITY Act, specifically the heated debate over stablecoin rewards. A positive compromise could signal unprecedented regulatory progress and ignite institutional confidence.

Simultaneously, Wednesday’s NFP and CPI data will directly shape Federal Reserve policy. Softer inflation and jobs numbers could revive hopes for a March rate cut, weakening the dollar and boosting liquidity for risk assets like Bitcoin. This macro pivot is precisely what the crypto market needs to reverse its current risk-off sentiment.

Making a Bitcoin Price Prediction: Oversold and Poised?

Technically, Bitcoin is flashing extreme oversold signals that have historically preceded massive rallies. The weekly Relative Strength Index (RSI) has plunged to 27, a level not seen since the July 2022 bear market bottom. The Percentage Price Oscillator (PPO) is also at a February 2023 low.

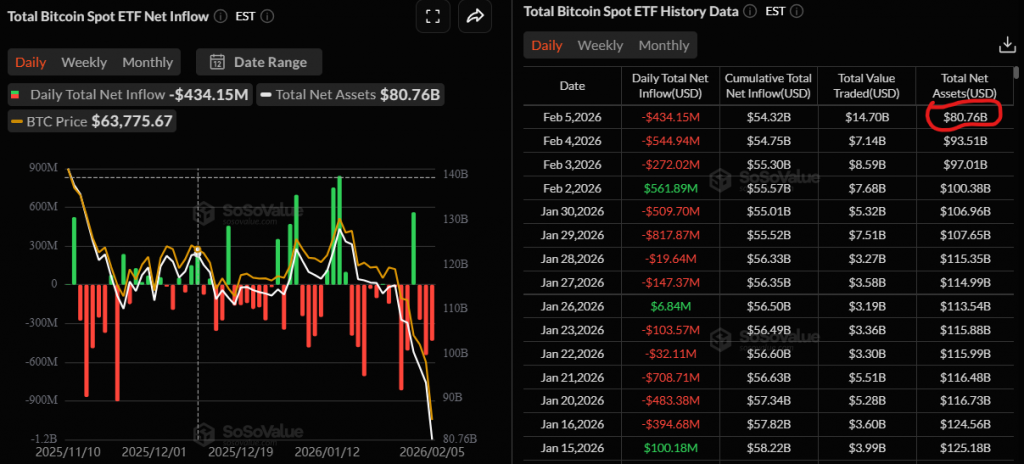

While price remains below key moving averages and the critical $74,420 support, this deep oversold condition suggests the selling may be exhausted. Our Bitcoin price prediction sees two paths: a bullish bounce toward $80,000 if macro catalysts align, or a breakdown below $60,100 that would invalidate the recovery thesis.

My Thoughts

This is the perfect storm for a trend reversal. We have political momentum, macro data catalysts, and deeply oversold technicals all converging. While the path of least resistance has been down, markets often turn when consensus is overwhelmingly bearish. I believe the conditions are ripe for a surprise to the upside. Watch for a positive signal from the White House summit or a soft CPI print as the potential spark. My prediction: BTC defends $60,100 and stages a fierce relief rally toward $74,420 as sidelined capital rushes back in.