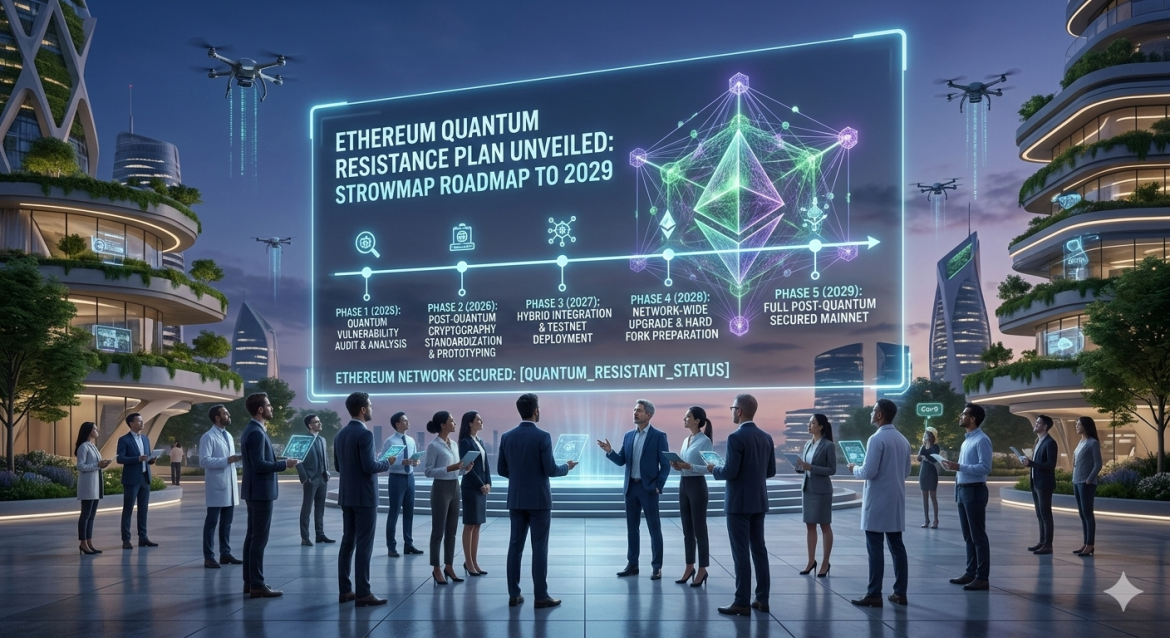

Ethereum is future-proofing itself against the biggest long-term threat on the horizon. Co-founder Vitalik Buterin has outlined a comprehensive Ethereum quantum resistance plan, addressing four critical areas vulnerable to quantum computing attacks. Simultaneously, Ethereum Foundation researcher Justin Drake introduced the “Ethereum Strawmap” —a coordination tool projecting seven protocol forks through 2029 targeting faster finality, gigagas throughput, native privacy, and post-quantum cryptography .

The Ethereum Quantum Resistance Plan: A “Ship of Theseus” Approach

Buterin identified four quantum-vulnerable components in Ethereum’s current architecture:

- Consensus-layer BLS signatures – Used by validators to attest to blocks

- KZG commitments – Powering data availability sampling

- ECDSA signatures – Used by externally owned accounts (EOAs)

- Application-layer proofs – Using KZG or Groth16 in ZK applications

The good news? Each component can be replaced incrementally—what Buterin calls a “Ship of Theseus” overhaul—without halting the network .

For consensus, he proposes replacing BLS signatures with hash-based signatures like Winternitz variants, potentially using STARKs for aggregation under lean consensus . Before full lean finality, Ethereum could deploy a “lean available chain” with fewer signatures per slot, reducing aggregation demands .

Data Availability and Account Abstraction

Data availability presents unique challenges. Ethereum currently relies on KZG commitments for erasure coding. While STARKs could theoretically replace KZG, they complicate 2D data availability sampling and require recursive proofs larger than blobs . Buterin suggests PeerDAS and 1D sampling may suffice given Ethereum’s conservative scaling posture .

For EOA signatures, native account abstraction under EIP-8141 enables accounts to adopt quantum-resistant schemes. However, hash-based signatures cost roughly 200,000 gas to verify compared with 3,000 gas for ECDSA—a significant premium . Lattice-based signatures verify even less efficiently today, though proposed vectorized math precompiles could reduce gas costs through NTT and dot product operations .

The Strawmap: Seven Forks, Five “North Stars”

Justin Drake’s Ethereum Strawmap outlines five ambitious targets:

- Fast L1 finality – One-round BFT algorithm called “Minimmit” enabling 6-16 second finality

- Gigagas L1 throughput – Targeting 10,000 TPS on base layer

- Teragas L2 scaling – Enabling 10 million TPS across Layer 2 networks

- Post-quantum L1 security – Full quantum resistance by 2029

- Private L1 transfers – Native privacy features

The roadmap projects seven forks through 2029, assuming a six-month cadence . Slot times could gradually fall from 12 seconds to as low as two seconds, following a measured formula with safety validation at each step .

My Thoughts

This Ethereum quantum resistance plan is a masterclass in proactive protocol governance. Unlike Bitcoin, where quantum discussions often devolve into debate, Ethereum is already engineering solutions.

The “Ship of Theseus” model is elegant—replace parts without breaking the whole. The gas cost differentials (200K vs 3K) are real, but recursive aggregation at the protocol layer could push verification overhead “close to zero” over time .

The Strawmap’s ambition is breathtaking. 10,000 TPS on L1 would make Ethereum faster than most centralized payment networks. 10 million TPS on L2s is infrastructure-level scaling. And post-quantum security by 2029 means Ethereum will be ready before the threat materializes.

For investors, this is the kind of long-term thinking that justifies holding ETH through cycles. The roadmap extends to 2029, but the compounding value accrual—through staking, fees, and now quantum readiness—is happening now.