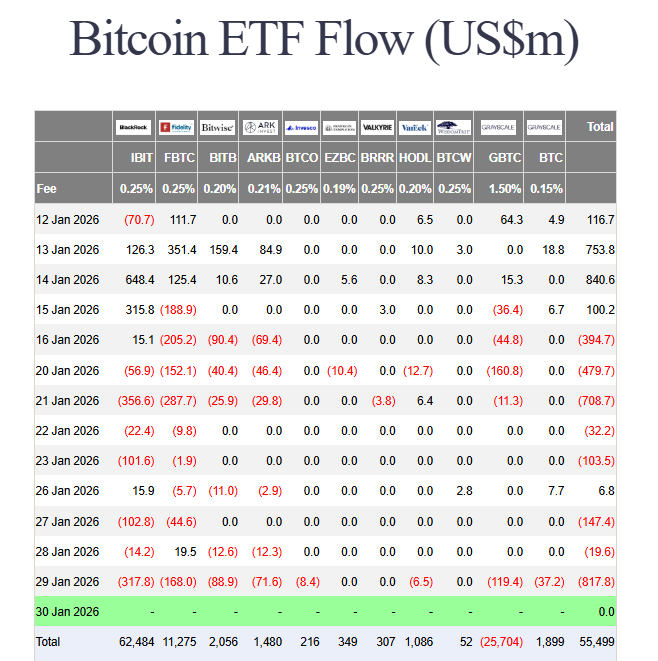

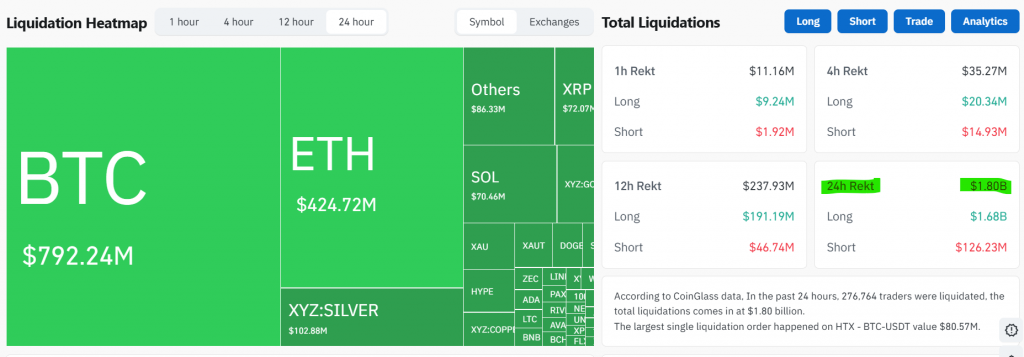

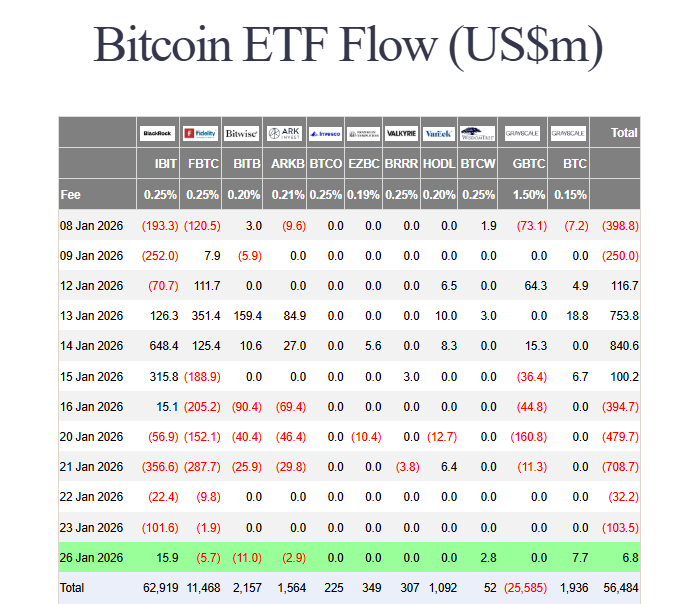

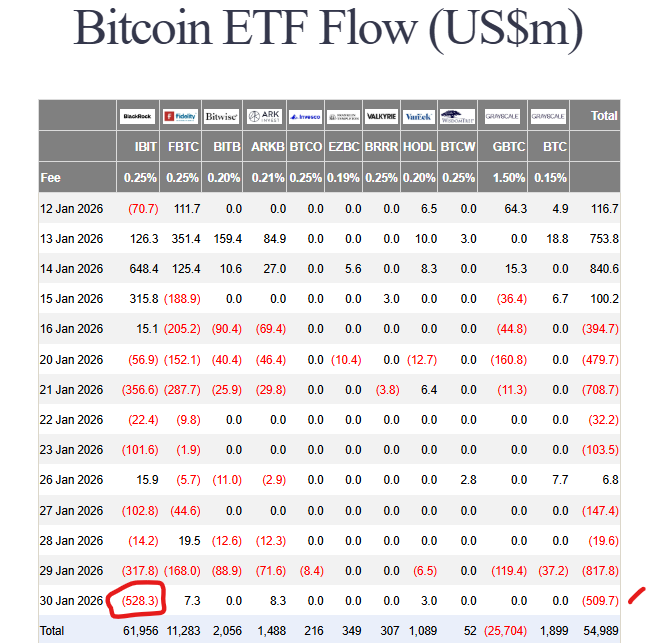

The institutional exit is accelerating. Bitcoin spot ETFs have now bled capital for four out of the last five trading sessions, with this week’s net Bitcoin ETF Outflows soaring to a staggering $1.49 billion. This relentless selling wave, led by the largest fund issuers, is applying severe downward pressure on prices and raising questions about a deeper sentiment shift.

A Detailed Look at the Bitcoin ETF Outflows

The data reveals a clear and concerning trend. BlackRock’s IBIT led the exodus on January 30th with a single-day withdrawal of $528.3 million. While Fidelity’s FBTC saw a minor $7.3 million inflow, it was a rare positive in a sea of red. The selling crescendo peaked on January 29th with a massive $817.87 million single-day outflow—the largest since this wave began.

This sustained redemption streak has tangible impacts. Total net assets for these ETFs have dropped from $115.88 billion to $106.96 billion in just one week. Over a two-week period, approximately $2.82 billion has been drained from these products.

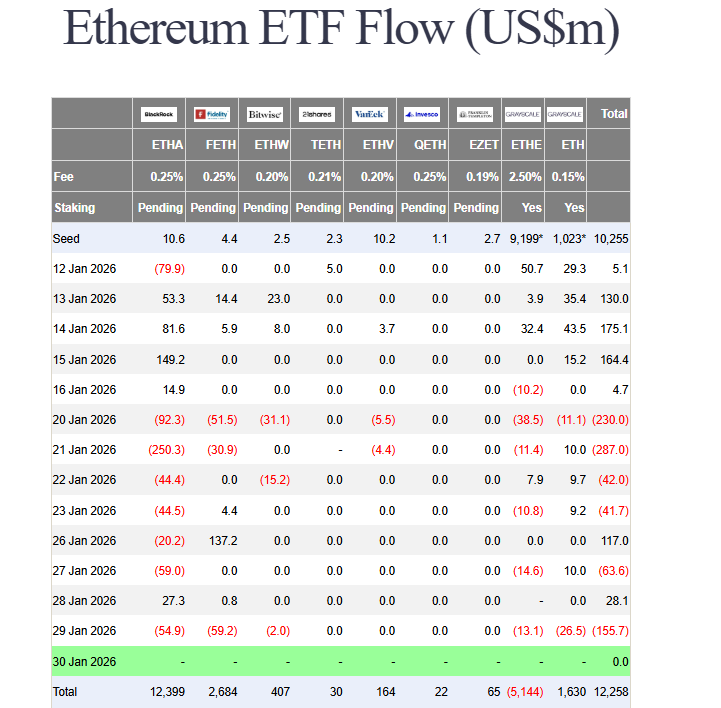

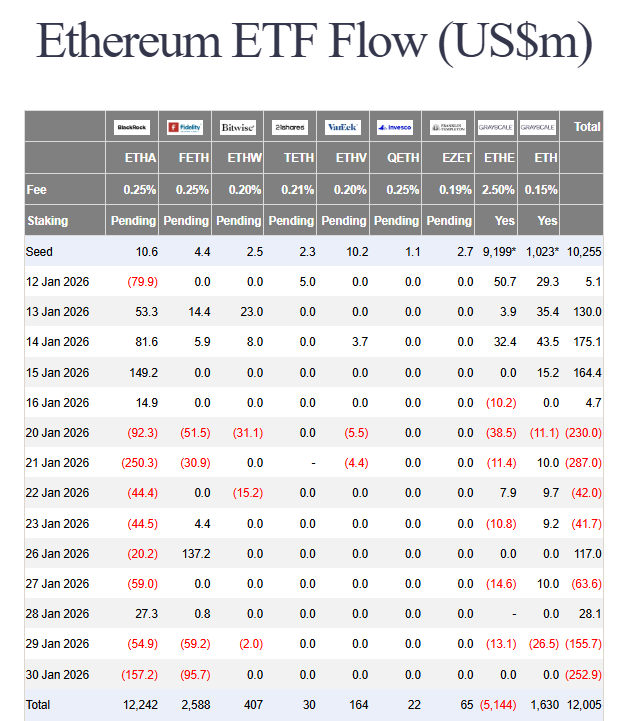

Ethereum ETFs Face Parallel Pressure

The pain isn’t isolated to Bitcoin. Ethereum spot ETFs mirrored the trend, posting $252.87 million in net outflows on the same day. BlackRock’s ETHA and Fidelity’s FETH funds were again the primary sources of selling. This parallel movement confirms a broad-based institutional risk-off stance toward core crypto assets, not just a rotation.

My Thoughts

This is a clear signal that macro and volatility have overwhelmed the “structural buying” thesis. These outflows represent real, persistent selling pressure that the spot market must absorb. While frightening, this purge of “weak institutional hands” may be a necessary cleansing before a healthier rally can begin. The market needs to see these flows stabilize and revert to neutral before confidence can return. Until then, the path of least resistance remains skewed to the downside, with ETF flow data being the most critical metric to watch.