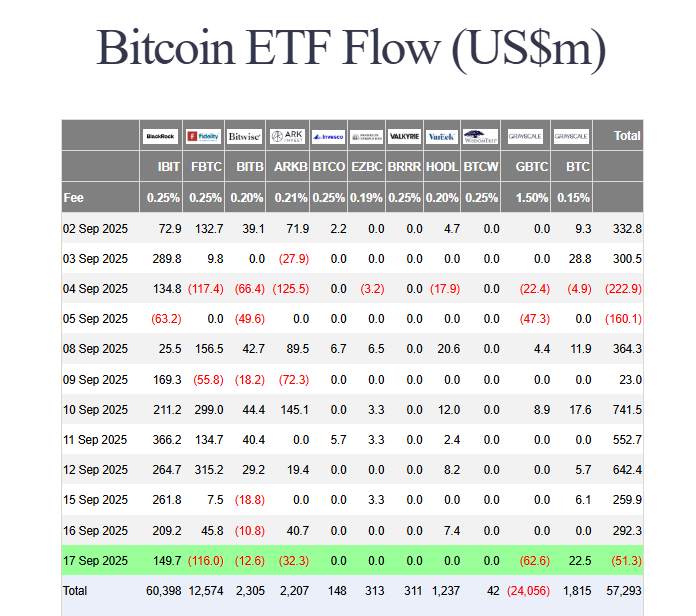

In a bold move that defies the current market downturn, Strategy has executed another major Strategy Bitcoin purchase. The business intelligence firm continues its unwavering accumulation strategy, buying hundreds of millions of dollars worth of BTC even as prices fall.

The Details of Strategy Bitcoin purchase

The company officially announced the acquisition of 850 Bitcoin for a total of $99.7 million. This translates to an average price of approximately $117,344 per BTC. Consequently, Strategy’s gigantic treasury now holds an astounding 639,835 BTC. The company’s total investment stands at $47.33 billion, with an average cost of $73,971 per coin.

To fund this purchase, Strategy sold shares of its MSTR and STRF stock. Specifically, the sales raised $80.6 million and $19.4 million, respectively. This marks the company’s eighth consecutive weekly Bitcoin buy, a spree that began in late July.

Saylor’s Unshakable Bitcoin Vision

Strategy’s co-founder, Michael Saylor, strongly hinted at this purchase in a recent social media post. He famously stated, “The Orange Dots go up and to the right,” signaling his long-term bullish outlook. Clearly, Saylor and his company have no plans to sell and intend to continue stacking sats regardless of short-term volatility.

Market Context: BTC and MSTR Stock Slide

This latest Strategy Bitcoin purchase comes during a significant slump for both Bitcoin and Strategy’s own stock (MSTR). Currently, MSTR stock is trading around $336, reflecting a drop of over 2% from last week. The stock recently hit a five-month low of $323.

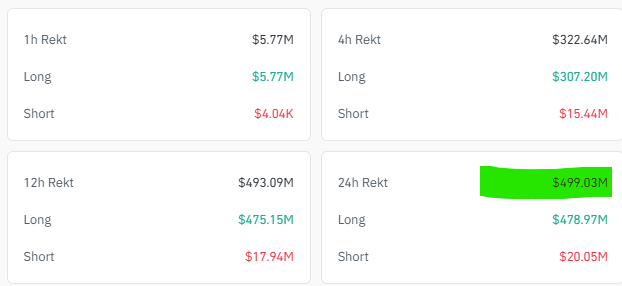

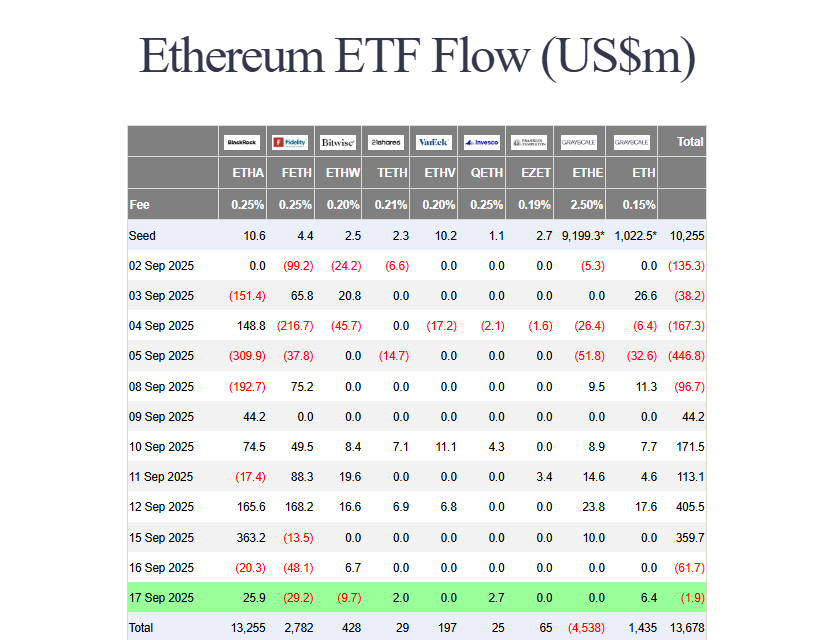

Similarly, Bitcoin’s price has faced pressure, falling over 2% in the last 24 hours to trade just below $113,000. This broader market decline is likely linked to macroeconomic factors, such as rising U.S. Treasury yields. Despite the downturn, Strategy’s conviction remains steadfast, showcasing a classic “buy the dip” mentality that continues to capture the attention of the entire crypto market.