Even with crypto prices under pressure, Altcoin ETFs inflow continue to signal strong institutional demand.

On November 6th, Solana, HBAR, and Litecoin ETFs each recorded positive net inflows, extending their green streaks despite ongoing volatility in the broader market.

While Bitcoin and Ethereum ETFs finally broke their six-day outflow streaks with small inflows, the real story remains the consistency and resilience of altcoin-focused ETFs.

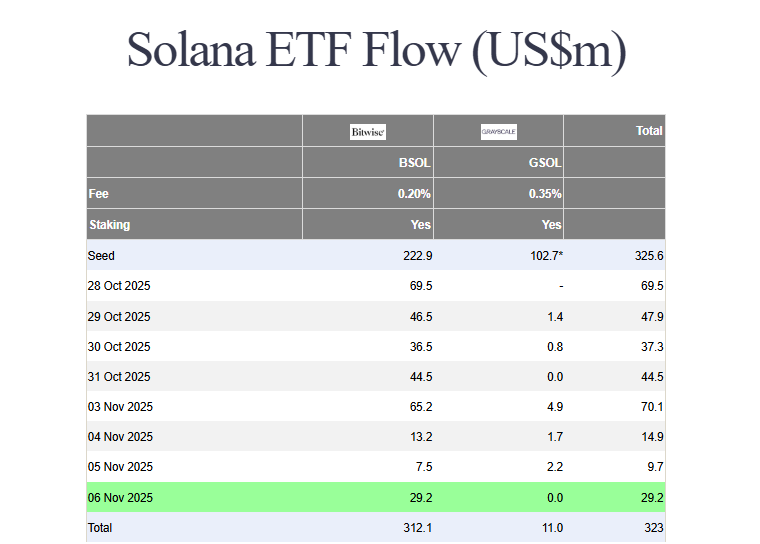

Solana ETF Records Eighth Straight Day of Inflows

The Solana ETF maintained its perfect record with an eighth consecutive day of positive inflows, totaling $29.2 million on November 6th.

All of these inflows came from the Bitwise Solana ETF, underscoring Bitwise’s growing role in institutional exposure to Solana.

Despite market pressure, $SOL has been holding between $154 and $155, down about 17% over the past week.

However, the sustained inflows show that institutions remain confident in Solana’s long-term prospects, especially as its DeFi and on-chain volumes continue to outperform many competitors.

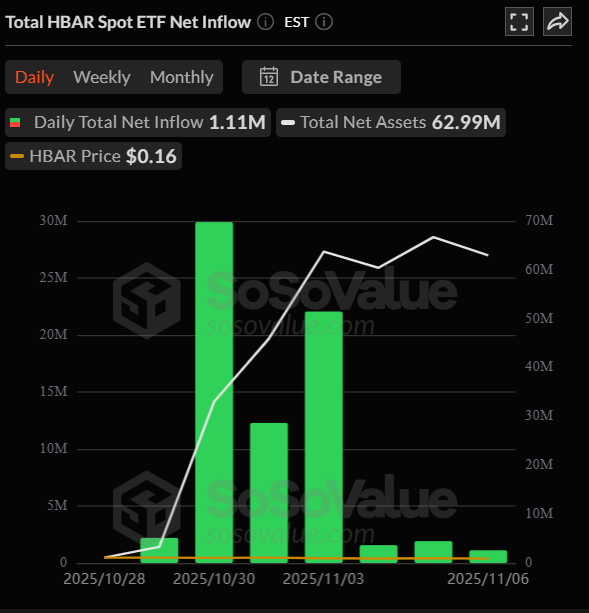

HBAR ETF Remains Positive Amid Market Turbulence

The HBAR ETF also posted another green day on November 6th, with a net inflow of $1.11 million.

While relatively modest, it continues the ETF’s streak of positive performance since launch — impressive given that $HBAR is trading around $0.1652, roughly 14% lower week-over-week.

This steady demand suggests that institutional investors are focusing on Hedera’s long-term enterprise adoption and strong fundamentals rather than short-term market fluctuations.

Litecoin ETF Keeps Clean Record of Positive Days

The Litecoin ETF joined the momentum with another positive inflow of $642,000 on November 6th, bringing its total assets under management (AUM) to $3.21 million.

Notably, the Litecoin ETF has never recorded a red day since launch — a promising start for the digital silver’s institutional exposure.

Meanwhile, $LTC saw a small rebound from $86.67 to $88.95, though it remains down 5.62% week-over-week.

Altcoin ETFs Inflow Show Institutional Confidence

The consistent Altcoin ETFs inflow across Solana, HBAR, and Litecoin highlight growing diversification among institutional investors.

While Bitcoin and Ethereum dominate the headlines, professional money continues to seek opportunities in faster, scalable, and innovative ecosystems like Solana and Hedera.

The fact that all three ETFs have remained positive since launch — despite a challenging market — reinforces the long-term potential of altcoins as a core part of institutional crypto exposure.

Conclusion: Strength Beyond Bitcoin and Ethereum

Even as Bitcoin and Ethereum ETFs finally snapped their losing streaks, Altcoin ETFs inflow remain the stronger story.

Solana, HBAR, and Litecoin ETFs continue to post steady inflows, demonstrating that conviction in alternative blockchain ecosystems is growing — and that institutions are not just watching the market dip; they’re buying it.