AVAX Price Support Tests Key Zone as Bitwise Files First Staking-Enabled ETF

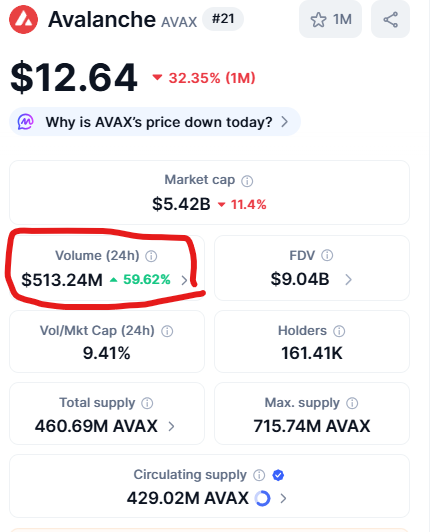

Amid a brutal market-wide sell-off, Avalanche (AVAX) is approaching a critical historical support zone near $8.64. Today’s 10.15% drop to $12.78 is undeniably bearish, yet a 48% surge in trading volume reveals a fierce battle between panic sellers and strategic accumulators. This clash at a major AVAX price support level coincides with a groundbreaking development: Bitwise has amended its ETF filing to include a staking feature, setting the stage for the first U.S. crypto ETF that allows shareholders to earn yield directly—a potential game-changer for long-term demand.

Technical Breakdown: Strong Bearish Momentum Meets Key Support

The technical picture is currently dominated by sellers. The DMI indicator shows a stark bearish trend, with the -DMI at 35 vastly overpowering the +DMI at 13. The high ADX reading of 46 confirms this downward trend has significant strength. However, this momentum is driving AVAX toward the historically significant AVAX price support zone around $8.64. This level has acted as a powerful launchpad in past cycles, and a retest could create a prime accumulation area for patient investors. The immediate resistance to watch for any recovery sits at $15.33.

Bitwise’s Staking ETF: A Structural Bullish Catalyst

Beyond the charts, a fundamental shift is occurring. Bitwise’s updated ETF filing proposes staking up to 70% of the fund’s AVAX holdings, offering shareholders direct exposure to staking rewards. This transforms the ETF from a simple price-tracker into a yield-generating asset, a first for U.S. crypto ETFs. With a competitive 0.34% fee and a planned Q1 2026 launch on NYSE Arca, this product could attract a new class of income-focused institutional investors. Crucially, by locking up a substantial portion of the fund’s assets, it would also reduce the liquid circulating supply of AVAX, creating a structurally bullish supply shock over time.

My Thoughts

This is a classic setup where short-term pain meets long-term potential. The path to $8.64 may be volatile, but it would represent a high-conviction accumulation zone. Bitwise’s staking ETF is a masterstroke—it solves the “yield problem” for institutions and directly impacts AVAX’s tokenomics. While the market is fixated on today’s red candle, the smart money is planning for the 2026 launch. This divergence creates opportunity.