Bitmine’s Massive Ethereum Accumulation Continues with $82 Million Purchase

While retail investors panic, the smart money is loading up. Bitmine Immersion Technologies, the world’s largest corporate Ethereum treasury, has executed another colossal Ethereum accumulation, purchasing 28,625 ETH worth approximately $82.11 million. This latest buy, reported by Lookonchain, follows a $60 million acquisition just days earlier, demonstrating a relentless strategy to buy the dip. Backed by Fundstrat’s Tom Lee, Bitmine is signaling extreme conviction, proving that major institutions see current prices as a generational buying opportunity despite the brutal market downturn.

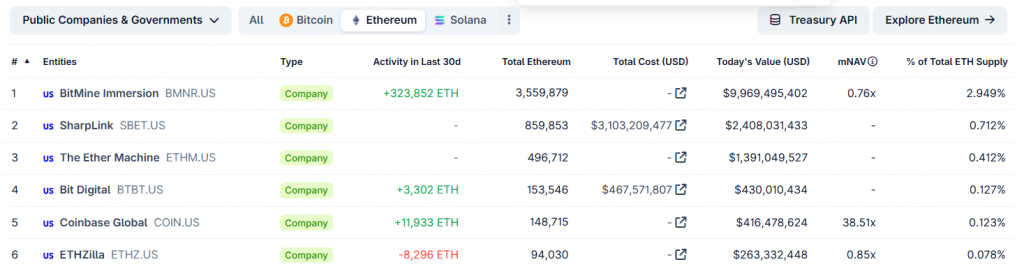

A Treasury Building a 3% ETH Stake

This aggressive Ethereum accumulation is part of a much larger, calculated plan. Last week, Bitmine confirmed its holdings had reached a monumental 3.6 million ETH—representing 2.9% of the entire circulating supply. When combined with its Bitcoin stash, stake in Eightco Holdings, and cash, the firm’s total crypto holdings are nearing a staggering $12 billion. This isn’t speculative trading; it’s a strategic treasury reserve operation on a scale never before seen in the crypto space. The market is taking notice, with BMNR stock jumping nearly 5% in premarket trading as investors cheer the firm’s decisive action.

Can Price Follow the Institutional Demand?

Despite this overwhelming institutional demand, ETH’s price action remains weak, currently trading around $2,793 after failing to reclaim the critical $2,900 resistance level. Derivatives data shows selling pressure, with futures open interest declining. Analyst Ted Pillows warns that if ETH cannot break and hold above $2,850-$2,900, it risks a further drop toward $2,500. This creates a fascinating divergence: while fundamental, long-term demand from giants like Bitmine is exploding, short-term technicals and trader sentiment are overwhelmingly bearish.

My Thoughts

This is the clearest signal of a bottom formation I’ve seen. Bitmine isn’t just dipping a toe in; they’re deploying a firehose of capital into ETH. They are effectively creating a non-cyclical demand base for Ethereum. While traders focus on next week’s price, Bitmine is building a position for 2026 and beyond. This level of institutional accumulation creates a underlying bid that will inevitably overpower short-term technical weakness. When the market turns, the rebound will be explosive.